MicroStrategy spent another $ 10 million to buy Bitcoin. Michael Saylor, CEO of MicroStrategy, shared the announcement of the acquisition of the cryptocurrency. According to him, MicroStrategy acquired approximately 295 more bitcoins.

The average purchase price of one coin was $ 33,808, after which the company has at its disposal 71,079 BTC totaling $ 1.145 billion with an average purchase price of $ 16,109. According to analysts, such activity of large players will seriously change the value of the main blockchain asset.

To begin with, it is worth explaining the reasons for the possible shortage of bitcoins, the occurrence of which experts admit in the future. First of all, the maximum amount of cryptocurrency is strictly limited to $ 21 million, and this number has its own explanation. Accordingly, it will not work to create an extra ten million BTC – no matter who asks for it.

In addition to this, cryptocurrency is actively bought up by large investors. To illustrate, we can cite data on the activity of the Grayscale fund, which acquired 40 thousand bitcoins in 2021. What is most surprising: during the same period, about 26 thousand BTC appeared on the cryptocurrency network due to mining. That is, one company bought more coins than they appeared. And there are several such companies, as we already know.

Since in the second half of 2020 – after the activation of investor companies – the Bitcoin rate increased significantly, analysts predict the continuation of this trend. And already on a much larger scale.

What will happen to Bitcoin in the future

As you can understand, MicroStrategy managed to make huge profits on cryptocurrency in just a few months – today it is trading at $ 35,670. This is the equivalent of 9.3 percent growth over the past week.

MicroStrategy now belongs to a growing list of large companies that continue to actively buy bitcoin. Moreover, the organization’s desire to own the crypto was so high that it had previously even issued its own bonds in order to get even more funds to invest in digital assets.

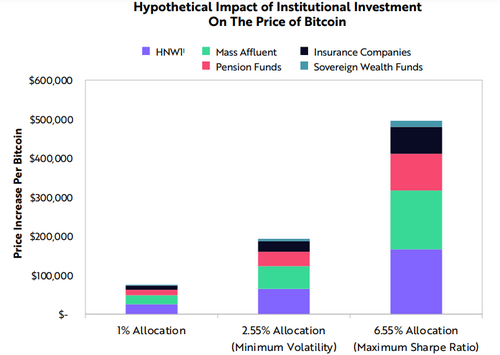

The strategy of converting even a small part of the budget of companies into BTC will lead to a rapid increase in the price of the latter, analysts of the investment firm Ark Invest are sure. According to their recent forecast, an investment of at least 1 percent of the capital of the companies included in the S P500 stock index would be enough for the price of Bitcoin to rise by at least $ 40,000. Here is a quote from Cointelegraph’s research from experts.

Based on the volume of searches compared to 2017, the rise in the price of Bitcoin does not seem to be driven by the hype. As cryptocurrency gains more and more credibility, some companies see it as an opportunity to invest part of their balance.

Here analysts clearly point out the difference between the events in 2017 and the current one. Judging by their statements, the current stage of growth is much more solid and fundamentally justified. And this is also happening due to the activity of large investors.

In terms of the long-term impact that corporations could have on the bitcoin shortage, Ark predicts that the likely distribution of their capital will well exceed the aforementioned 1 percent threshold.

Based on daily returns by asset class over the past ten years, our analysis shows that the distribution of company funds in bitcoins should range from 2.55 percent with volatility minimized to 6.55 percent for maximum return. According to the simulated distribution of the ARK portfolio, such indicators can lead to an increase in the price of Bitcoin by the amount of from 200 to 500 thousand dollars.

That is, the logic here is simple: experts predict a continued growth in the popularity of the main digital asset among companies. Since, against this background, they will increasingly invest in cryptocurrency, its rate will increase, taking into account the increase in demand. However, in order for Bitcoin to reach the level of hundreds of thousands of dollars, the asset must take a certain share in the portfolio of companies.

In other words, in this growth cycle, BTC can still very much surprise its investors by conquering new peaks. Even now, reaching a six-digit figure in the cryptocurrency value column does not seem like such a fantastic scenario – at least taking into account the asset growth rate at the end of 2020.

We believe that the activity of investment funds and large companies will really have a positive effect on the Bitcoin exchange rate. Of course, you shouldn’t be guided by the named numbers, since their achievement is not guaranteed by anything, but it is worth looking closely at the activities of Grayscale, MicroStrategy and other giants. The more coins they buy, the less the rest will get.