Levey had already taken on the HSBC role by the time the bank was fined nearly $2 billion by the U.S. Department of Justice for failing to stop the transmission of funds from drug-running by its customers. The bank was required to take steps to mitigate this risk moving forward but was otherwise not heavily penalized.

The Facebook-created consortium announced Wednesday that Levey would be joining «later this summer» and will be overseeing its efforts to «combine technology innovation with a robust compliance and regulatory framework.» He has been at HSBC since 2012.

The Libra Association has named HSBC Chief Legal Officer Stuart Levey as its first chief executive.

He oversaw sanctions enforcement through the U.S. Office of Foreign Asset Control and anti-money laundering regulations through the Financial Crimes Enforcement Network (FinCEN), according to a press release.

«I am honored to join the Libra Association as it charts a bold path forward to harness the power of technology to transform the global payments landscape,» Levey said in a statement.

«Technology provides us with the opportunity to make it easier for individuals and businesses to send and receive money, and to empower more than a billion people who have been left on the sidelines of the financial system, all with robust controls to detect and deter illicit financial activity.»

Levey said he looks forward to working with governments and regulators in building out the Libra project.

Libra has made a number of public moves recently, announcing new members including global nonprofit Heifer International and ecommerce site Checkout.com. The consortium, unveiled by Facebook last June, has also begun the process to receive a payments license through the Swiss Financial Market Supervisory Authority.

The group did not announce a revised launch date for the libra stablecoins, which were originally set to go live within the first half of 2020. Libra revamped its original vision last month, scaling back plans for a global stablecoin in favor of a series of fiat-backed stablecoins.

In a statement, Libra Association board member and Andreessen Horowitz partner Katie Haun said, «Stuart brings to the Libra Association the rare combination of an accomplished leader in both the government, where he enjoyed bipartisan respect and influence, and the private sector where he managed teams spread across the globe.»

She added: «This unique experience allows him to bring a wealth of knowledge in banking, finance, regulatory policy and national security to the Association and strike the right balance between innovation and regulation.»

Libra Crypto Is ‘Undoubtedly’ a Wakeup Call for Central Banks, Says ECB Exec

Facebook’s Libra could potentially solve some of the problems in the international payments market, but it might create a number of others that will require creative thinking by the regulators, says an European central banker.

In comments to the German federal parliament Bundestag on Wednesday, Benoit Coeure, a member of the Executive Board of the European Central Bank (ECB), said “Libra has undoubtedly been a wakeup call for central banks and policymaker”, and they should respond to these challenges.

He added that stablecoins, in particular Facebook’s Libra cryptocurrency, could help connect the 1.7 billion people globally who are now off the financial grid while at the same time making cross-border payments cheaper, faster and more transparent.

In improving access and facilitating cross-border retail payments, they could address two key deficiencies in the current architecture of the market.

Libra, which is being supported by a consortium led by Facebook, will be connected to a huge existing user base, giving it a “truly global footprint”, according to Coeure, who chairs the Committee on Payments and Market Infrastructures at the Bank for International Settlements. He is also the head of the Group of Seven (G7) Committee on stablecoins.

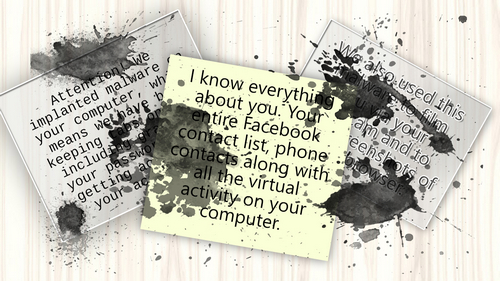

The central banker raises a number of concerns about stablecoins. He said that they can be used for laundering money and financing terrorism, and he notes the possibility of consumer protection, data security, network stability, competition and taxation issues.

He adds that stablecoins have serious implications for monetary policy and financial stability, as the coins can have an impact on money supply outside the normal channels, while the failure of the promised peg or the loss of confidence could have systemic implications.

“There may be the risk of the monetary sovereignty of countries being infringed”, he was quoted as saying in written summary of his comments, which was published by the Bank of International Settlements.

While he believes that much can be done to regulate the new products within existing policy frameworks, he said that new approaches are needed. He also said rules need be applied in an “internationally consistent” manner, suggesting a degree of coordination between institutions globally.

In the comments, he said that the G7 group on stablecoins would be offering its recommendations in time for the IMF-World Bank meeting, which runs Oct. 14-20.

His comments come as Libra faces hostility from some quarters, especially in Europe and China, but are in line with previous statements by the central banker, indicating that a consensus is developing around a balanced approach of welcoming but tightly supervising the stablecoin.