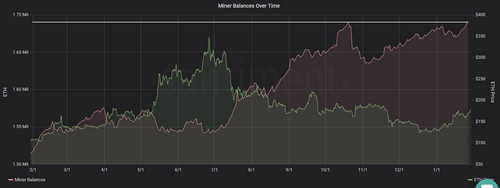

The number of ether tokens held by all ETH mining pools is back near its all-time high of 1.69 million ETH set in October, according to crypto market data platform Santiment.

Ethereum miners are hoarding ether tokens, and this could indicate high confidence in the project.

The rise from November’s low of 1.64 million has happened in a stable and undisrupted manner.

«The steady accumulation suggests high confidence levels in the project among the majority block creators, at the very least relative to the current market conditions,» Santiment’s founder Maksim Balashevich wrote in Spencer Noon’s monthly Substack newsletter.

The cumulative balance of all ETH mining pools has risen by 11 percent from 1.52 million a year ago.

Notably, miner balances rose sharply from 1.54 million to 1.69 million in four months to October even as prices halved from $366 to $170.

One possible reason miners are willing to accumulate coin balances amid lower prices is market sentiment had turned bullish following the cryptocurrency’s 120 percent rally in the first six months. Price dips have been largely viewed as bull market corrections by the analyst community.

The cryptocurrency, however, continued to lose altitude and fell below $170 in late October, prompting some of the miners to liquidate their holdings, as noted by Balashevich.

As a result, cumulative balances fell back to 1.64 million by early November.

Mining profitability is heavily influenced by price gyrations. A sustained price slide hurts revenue, forcing small and inefficient miners to scale back operations. While moving off blockchain, these miners often sell their coins to make up for mining-related losses, adding to bearish pressures around prices.

Ether’s price has rallied by 36 percent in January, and the broader trend seems to have flipped bullish. Thus, miner balances could soon rise to new record highs above 1.69 million.

“Barring major market volatility this time around, we’re likely to breach this milestone within the next few days”, Balashevich wrote.

Fidelity Joins Blockstream’s New Institutional Bitcoin Mining Service

Blockchain technology company Blockstream has announced details of its Bitcoin mining services. In a blog post on Aug. 8, the company revealed two massive data centers for enterprise class co-location services, along with Blockstream Pool, using the BetterHash protocol. Its aim is to maintain the decentralization of the Bitcoin network.

Your Bitcoin mining equipment, Blockstream’s data-centers

The data centers, located in Quebec and Georgia, account for a combined 300 megawatts of energy capacity. At full capacity, populated with the latest mining rigs, this could account for around 7.5% of the entire network hashrate.

The facilities provide a turnkey solution for co-location of clients’ mining equipment, covering delivery to the data-center, installation and maintenance. Mining rigs are managed remotely by the customer, giving real-time analytics and control over each device’s operation.

The service is currently geared towards enterprise and institutional customers, and Fidelity Center for Applied Technology was revealed as an early customer. Fidelity is reportedly filed for a New York Trust License last month.

First mining pool using BetterHash protocol

The other part of Blockstream’s mining service provision is the world’s first mining pool using the BetterHash protocol. BetterHash reportedly allows individual miners to control which transactions are included in their newly mined blocks.

This solves a key issue with many mining pools, in which the pool operators determine which transactions to include. As such, decentralization is increased, and potential attacks on the network become much more difficult.

Away from mining, Blockstream is busy developing its Liquid sidechain project, bringing speed and cost benefits to the Bitcoin network.