Jobs in the field of cryptocurrency and blockchain technology are on the rise, according to Indeed, a leading job listing platform and search engine. The company analyzed millions of job postings on Indeed.com to determine the current state of the crypto job market in the U.S.

The results were published Thursday by the company’s tech hiring platform, Seen by Indeed.

The number of job vacancies in the crypto industry is growing but fewer people are searching for them, according to a major U.S. job listing website. Thousands of jobs relating to Bitcoin, cryptocurrency, and blockchain technology are currently available as new employers seek to enter the space and existing players expand operations.

More Jobs, Fewer Searches

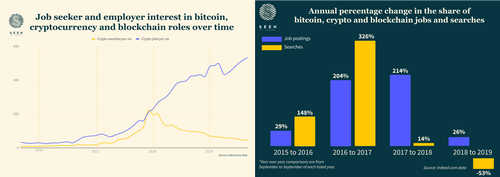

“According to Indeed.com, in the four-year period between September 2015 and September 2019, the share of these jobs per million grew by 1,457%. In that same time period, the share of searches per million increased by ‘only’ 469%”, a blog post on Seen by Indeed’s website details. Looking at data over the past year alone, crypto job listings increased by 26% while crypto job searches decreased by 53%.

The number of job postings grew the most between 2017-18 while the number of job searches grew the most in 2016-17. This year, the number of crypto jobs searched decreased for the first time. The company also revealed that the top five tech jobs in the industry are software engineers, senior software engineers, software architects, full stack developers, and front end developers.

Top Employers: Who’s Hiring

At the time of this writing, there are 1,090 crypto-specific jobs, 293 Bitcoin-specific jobs, and over 2,000 blockchain-related jobs listed on Indeed.com. In addition, 116 listings specifically mention smart contracts and 64 refer to distributed ledger technology. While most are full-time jobs, there are also part-time, contract, internship, commission-based, and temporary jobs.

Employers with the most crypto and blockchain-related job listings include Cisco, IBM, Collins Aerospace, Deloitte, Amazon.com, Accenture, Coinbase, Ripple, EY, Gemini Trust, Facebook, General Dynamics Information Technology, Lockheed Martin Corp., Overstock.com, and JPMorgan Chase.

Companies seeking to fill cryptocurrency-specific job vacancies include Coinbase, 72 jobs; Gemini Trust, 43 jobs; Gemini, 36 jobs; Praetorian, 28 jobs; Revolut, 26 jobs; Facebook, 25 jobs; Kraken, 24 jobs; JPMorgan Chase, 24 jobs; Cyphertrace, 19 jobs; Binance, 14 jobs; Chainalysis, 11 jobs; Paxful, 10 jobs; Bakkt, 8 jobs; and Huobi, 8 jobs. Salaries vary by employer and job. Revolut’s jobs on Indeed.com start at $63,600, Gemini Trust and Gemini $68,000, Praetorian $84,100, and Coinbase $71,100.

Indeed operates job listing platforms for 63 countries. The U.K. has over 1,000 jobs relating to Bitcoin, cryptocurrency or blockchain technology listed. Besides Indeed, there are other websites with crypto job listings, as news.Bitcoin.com previously reported. Job seekers can also approach companies directly. Bitcoin.com also has some job openings.

Moreover, government agencies are increasingly filling crypto-related positions. The U.S. Federal Reserve, for example, said earlier this month that it is looking for a candidate to oversee digital currency research. The New York State Department of Financial Services announced a job vacancy last month for a Deputy Superintendent for Virtual Currency.

Crypto Lender Nexo Pays Token Holders Over $2.4 Million in Dividends

Crypto lending firm Nexo has paid its token holders a total of $2,409,574.87 in dividends. Nexo reportedly has reached an annualized dividend yield of 12.73%.

Nexo announced the completion of its dividend payments in a press release on Aug. 16. According to the press release, Nexo has a user base of over 250,000. Moreover, Nexo’s dividend yield is purportedly higher than every dividend-paying stock listed on the SP 500 market index.

Nexo apparently pays out its total dividend in two parts – 50% comes from the Nexo Base Dividend and the other 50% from the Nexo Loyalty Dividend. Nexo claims that its model is designed to reward long-term investor confidence and decrease market volatility following dividend payouts.

The Nexo MasterCard

As noted in the press release, Nexo unveiled a MasterCard-branded credit card for crypto on Aug. 2. In its announcement, Nexo claimed its Nexo Card was the first in the world to let users pay in cryptocurrency without actually spending it. Nexo elaborated:

“When using the Nexo Card to purchase goods and services, you actually pay using your Nexo flexible open-ended revolving credit line that is backed with your crypto holdings and thus not selling any of them, which is giving you the freedom to spend today and sell your holdings whenever you want in the future to pay back the loan.”

Dividend payments through tZERO

Earlier this week, tZERO, the blockchain-based subsidiary of the retailer Overstock, announced the opening of the company’s preferred equity security tokens to non-accredited investors. This allows non-accredited token holders to earn money through company dividends. Per the announcement, tZERO said it might distribute a quarterly dividend of 10% of the company’s adjusted gross revenue. Moreover, the company said it was considering paying out dividends in more than just the United States dollar, with Bitcoin, Ether (ETH) and other security tokens being possible modes of payment.