Bitcoin and Bonds Could Complement Each Other in Portfolios

The report by Bloomberg went on to point out that Bitcoin might ‘be a prudent addition to low-yielding bond portfolios’.

This is due to the fact that the world is leaning towards a digital future and the upside potential of holding Bitcoin outweighs the risks of no exposure.

China Exiting Bitcoin Mining Makes BTC More Decentralized and Stronger

With respect to the ongoing Bitcoin mining crackdown within China, the team at Bloomberg pointed out that these events might result in short-term pain for longer-term gain. This is when viewed with the perspective that the U.S and other global jurisdictions, will now have a chance at embracing Bitcoin without the lingering fact that mining is controlled by one country.

Consequently, the Bitcoin mining crackdown in China will enhance decentralization and strengthen the BTC network.

- Bitcoin is on track to becoming a decentralized reserve and store of value asset

- Bitcoin might become a good companion for portfolios which also have low-yielding bonds

- The world is leaning towards a digital future and Bitcoin is at the forefront

- China banning BTC mining makes the Bitcoin network more decentralized and strengthening the network

The team at Bloomberg has released the July edition of their monthly Crypto Outlook Report. In this month’s issue, the team at Bloomberg has concluded that Bitcoin is ‘on track to becoming a globally accepted decentralized reserve and store-of-value asset’.

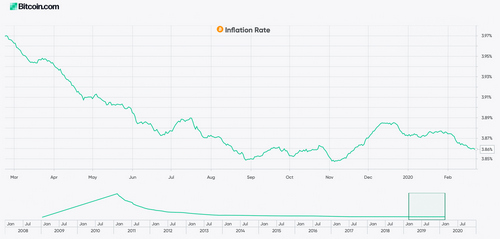

According to their analysis, Bitcoin is a potential savior in the current global financial environment of continual money printing. They explained this fact through the following statement and accompanying chart.

Bitcoin appears on track to becoming a globally accepted decentralized reserve and store-of-value asset that’s easy to transport and transact, has 24/7 price discovery and relative scarcity, and is nobody’s liability or project.

Diminishing quantity juxtaposed with the propensity of currencies to debase over time and the substantial amount of money being pumped into the system is a solid foundation for Bitcoin’s price appreciation.