According to an official announcement on Aug. 26, holders of Binance coin (BNB), Ethereum Classic (ETC) and Tether (USDT) will be able to lend their assets and earn interest through Binance’s new service called Binance Lending.

Major crypto exchange Binance will launch its first crypto lending product on Aug. 28, 2019.

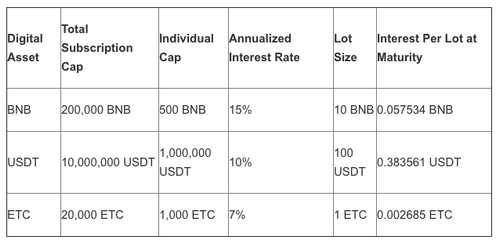

The services will be available for subscription from Aug. 28 till Aug. 29, Binance noted in the announcement. Lending products will have an initial 14-day period. BNB will have the highest annualized interest rate of 15% while the rates for USDT and ETC amount to 10% and 7%, respectively.

The first interest calculation period will be from Aug. 29 till Sept. 10. Binance added that interest payout time will take place immediately after the loan term matures. The annualized interest rates for upcoming phases will be adjusted based on market reception during this initial phase, the company stated.

Binance gives an example:

«If User A subscribes to 10 lots of BNB Lending (total lend of 100 BNB), the interest earned at maturity date will be 0.057534 BNB x 10 = 0.57534 BNB.”

Also today, Binance updated its Lending FAQ by adding a new section “Binance Lending Service Agreement”, claiming that the Binance Lending assets will be used in cryptocurrency leveraged borrowing business on Binance.com.

Swiss Crypto Banks Receive Licenses From Financial Regulator

The Swiss Financial Market Supervisory Authority (FINMA) has reportedly granted two banking and securities dealer licences to crypto-focused banks.

Two Swiss crypto-specializing firms, Seba Crypto AG and Sygnum have received banking and securities dealer licenses, the banks said in separate statements on Aug. 26.

With the new license, Seba expects to officially launch its new trading platform platform in early October 2019, the company stated. Seba’s plans include the establishment of a digital asset platform for professional traders, firms and institutional clients, as well as custody storage and asset management.

Sygnum said that regulatory approval will allow it to bring its digital asset offerings to market, which include a custody and integrated liquidity platform for major digital currencies including Bitcoin, Ether (ETH) and digital Swiss Franc tokens.

The news follows FINMA’s newly released guidance on regulatory requirements for blockchain-based payments. The guidance targets blockchain service providers including exchanges, wallet providers and trading platforms.

FINMA emphasized that blockchain sector businesses are not exempt from Anti-Money Laundering and Know Your Customer requirements.

At press time, crypto markets are seeing notable gains, with Bitcoin up over 2.52% over the past 24 hours to trade at $10,324, according to Coin360