Last week, Blockstack announced a new proposal through which node operators would be rewarded in bitcoin. The concept behind Proof of Transfer is that, for the cryptoasset ecosystem to run, electricity should only have to be converted into digital scarcity once.

Blockstack is integrating the security and the incentives of bitcoin to its ecosystem. CEO Muneeb Ali explains the changes.

In this interview with @nlw, Blockstack CEO Muneeb Ali explains how, by tying the security of Blockstack’s Stacks blockchain to bitcoin and allowing miners to be rewarded with BTC, Blockstack might be setting a precedent for how the crypto ecosystem looks to bitcoin as a base layer.

Top Bitcoin Developers Face Off in a Lightning-Powered Boxing Match

Wasabi Wallet developer nopara73 and BTCPay lead developer Nicolas Dorier faced off in a digital boxing match at bitcoin developer conference Advancing Bitcoin in London.In a video game from bitcoin startup Zebedee, the two developers played digital versions of themselves kicking and punching each other on a screen in front of a crowd of conference-goers.

Beyond yielding a few laughs, the esports smackdown was meant to highlight the power of bitcoin’s lightning network because the cutting-edge payments system is fast, cheap and lets users send tiny payments, even a fraction of a cent. Zebedee’s Raiki is an interactive game where the audience participates, potentially swaying the direction of the game with the strength of their wallets.

You can’t really do this with today’s centralized systems, such as PayPal and Visa, since the payments aren’t tiny, cheap or fast.

Crowding around the boxing developers, audience members who had a wallet with lightning loaded could go to a Raiki website featuring a QR code to pay whichever developer they wanted to win.

Power-ups included bombing the other player, making one player much bigger than the other or summoning a wizard hat.

Why add bitcoin to a game? And why lightning in particular?

«Innovation in the video game industry has been held back by the limitations of traditional financial services,» Zebedee declares on its website. «Game revenue are typically restricted to in-app purchases and advertisements.»

To the game’s creators, Raiki is a proof-of-concept for launching new in-game economies.

To that end, Zebedee’s closed beta product is a set of developer tools for adding lightning payments into video games.

Research: Bitcoin Futures Settlement Date Suggests 4% Gains Likely

Bitcoin is statistically likely to gain in the coming week as a new futures expiration event comes and goes, according to new data.

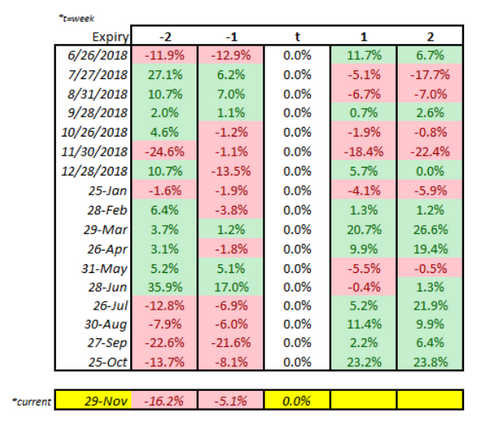

Compiled by trader an analyst Luke Martin on Nov. 25, figures charting Bitcoin price performance before and after each expiration show that overall, higher levels appear afterward.

Data: BTC stands to gain next week

Martin used CME Group’s monthly futures as a basis. Among the first futures to hit the market in December 2017, their settlement dates – of which Friday was one – have already attracted attention as a force for moving price.

Bitcoin price movements around futures settlement dates

“Takeaway: Generally experience selling pressure before and positive returns after”, he summarized.

Per the calculations, a negative return for Bitcoin investors a week before futures payout results in a positive return the following week – 73% of the time.

There are notable exceptions, such as Nov. 30, 2018 – a week prior, BTC/USD fell 1.1%, while after futures settlement, the pair dropped more than 18%.

On average, says Martin, post-settlement returns are positive the following week at 2.9%. The week after that fares better still, with an average 3.9% increase.

By contrast, the week before each event sees average losses of 2.4%. So far, last week’s performance was worse than usual at 5.1%, but settlement week conversely produced 7.7% gains.

Since Friday, CME Bitcoin futures are up around 2% with a settled price of $7,800, according to the latest data from the company.

No bears in futures markets

As Cointelegraph reported, futures markets, in general, continue to see strong performance despite bearish sentiment which has characterized Bitcoin price action in recent weeks and months.

This week, fellow operator Bakkt saw a clear record high for its futures trading volume. The personal best came on Nov. 27, when $42.5 million worth of contracts changed hands.

The previous record was $20.3 million on Nov. 22, while subsequent days also saw strong performance. On Friday, Bakkt traded $24.6 million.