According to Simon Peters, an analyst at crypto-friendly brokerage eToro, Bitcoin’s latest bout pertaining to volatility comes after the cryptocurrency “has been due for a price rupture for some time”.

Why is Crypto Down?

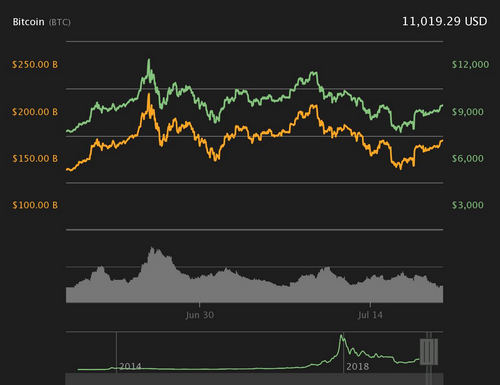

This week hasn’t been really too nice to Bitcoin. Since the start of the week, the cutting edge cryptocurrency has lost some sort of 20%, failing to break enhance from a long-term price triangle.

This spectacular move – which come as there were optimists calling for Bitcoin to break higher that will help $20, 000 – has gone many wondering why the Bitcoin price suddenly broke down. Various analysts have answered this unique pressing question.

Peters first claimed the fact pessimism surrounding Bakkt’s physically-deliverable Bitcoin futures is what ignited the most recent selloff. For those who didn’t detect the memo, the crypto community flipped bearish on the Monday morning after the shift managed to pull in less than $1,000,000 worth of volume although its first trading visit.

The eToro analyst added that it was BitMEX who perpetuated the sell-off, writing that “$600, 000, 000 worth of long localisation on platforms like BitMEX is what introduced about the price to dramatically downturn by over $1, thousand in a 30-minute period. ”

On the contrary Bitcoin Might Be Bottoming…

While the pessimism is still present in the match chambers of Crypto Stumbleupon, analysts are suggesting of Bitcoin might be bottoming out right here, or at least a level just somewhat lower than where BTC trafficed earlier this week.

Mitoshi Kaku, a easily heard technical analyst, argued a $7, 400 price point is definitely the “new $3, 300” for use with Bitcoin, making reference to the solid support that was the low-$3, 000s during December most typically associated with 2018.

Is ~7400, the fresh new 3300? I think there’s a superb probability of it. And, right here is the current model I have currently given the current conditions. Sticking with my strategy, I will no doubt long a small TF foi, like I did at 3165 and 3330, in case matters go lower. $BTC #Gann

– Mitoshi Kaku ??? (@CryptoSays) September 32, 2019

Other analysts have put forward the proposition that there are hard price operates over are levels just somewhat higher than that. For instance, $7, 700 is currently the lower Bollinger Band on Bitcoin’s one-week chart, which optimists accept as true the cryptocurrency will next above this week to stay effective.

On the highly recommended side, Bitcoin’s underlying metrics have continued to finish higher. Hans Hauge, the best senior quantitative researcher when crypto fund Ikigai Plus Management, recently drew towards hash rate, daily Bitcoin transactions, BTC’s price, construtor activity, inflation rate, and one push for the adoption at unorthodox monetary policies. That she remarked that these all present to that “Bitcoin looks great”, even if the cryptocurrency market presently fell off a tradicional cliff.

Available as Peters said:

“Fundamentals such as hashrate remains strong, and culture shock of crypto is still dancing at pace. With the many people conditions in mind, we could locate the price rise back up to $10,50, 000 within the space with all the next month. ”