While the bull market is still intact, bitcoin’s failure to close above the previous record high indicates bull market exhaustion – perhaps associated with investor discussion on social media of possible upcoming South Korean and EU legislation around cryptocurrencies.

After reaching a fresh all-time high yesterday, bitcoin could be losing its upside momentum.

The world’s largest cryptocurrency by market value clocked a new lifetime high of $11,831 at 20:30 UTC Sunday, but closed below the previous record high of $11,377, according to CoinDesk’s Bitcoin Price Index. At press time, BTC was trading at $11,238 – up 0.5 percent for the session.

As per CoinMarketCap, week-on-week, bitcoin (BTC) is up 18 percent, while on a monthly basis, it has gained more than 50 percent.

Further, a look at the price chart indicates the cryptocurrency could be in for a short-term pullback.

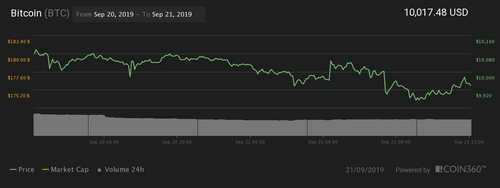

Bitcoin chart

The above chart shows:

- Bitcoin did clock a fresh record high yesterday, but could not close above the previous record highs near $11,500. A similar price action is seen today, as the cryptocurrency clocked a high in the $11,600 region, before falling back below the previous record high.

- Yesterday’s candle has a big upper shadow (gap between intraday high and daily close), which indicates bullish exhaustion.

- A break above the last Wednesday’s big doji candle high (previous record high) lacked volume support (i.e. trading volumes remained well below the level seen on last Wednesday).

- The relative strength index (RSI) shows overbought conditions.

View

- Bitcoin could re-test the psychological support level of $10,000. The ascending trendline (drawn from Nov. 12 low and Nov. 24 low) could offer support (today) around $9,900 levels.

- However, the 5- and 10-day moving averages are sloping upwards, indicating a drop below $10,000 could be short-lived.

- Only an end-of-day close below the rising trendline could be considered a sign of short-term trend reversal.

- In the larger scheme of things, the chart remains in favor of the bulls. As history shows, majors tops have been formed on the back of bearish price RSI divergence.