Thursday’s jump in bitcoin price, briefly as high as $7,800 on some spot exchanges, hurt short sellers in the crypto derivatives market. Those trades betting on crypto prices going downward have not returned to derivatives exchanges like BitMEX, said Vishal Shah, an options trader and founder of exchange platform Alpha5.

Since Thursday’s jolt in bitcoin prices, the cryptocurrency has traded in a tight range close to the $7,500 level. It has not only come back from the losses suffered in March, it’s also showing some upward momentum.

The price for one BTC is currently above 10-day and 50-moving averages on the daily charts, a bullish technical signal. “Despite the mid-March 2020 bitcoin sell-off when we saw a close to 50 percent drop, it has now, within a month, recovered 95 percent”, said Antoni Trenchev co-founder of crypto lender Nexo.

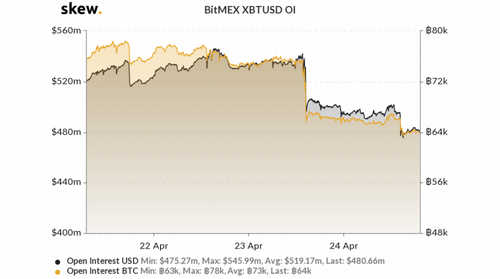

“What we saw yesterday was a collapse in open interest, and no real premium being built into the futures curve”, he told CoinDesk. As short sellers were wiped out on BitMEX Thursday during the bitcoin price spike, open interest dropped and it hasn’t recovered.

“It’s tough for me to digest that there’s new capital funneling in; it’s likely capital within the ecosystem sloshing around and targeting pain points”, Shah added. “It feels pretty firm, with the next battle trench likely in the $7,850 – $8,000 region.”

Inflows are needed to push crypto prices higher. Bitcoin’s year-to-date high was $10,510 on spot exchanges like Coinbase back on Feb. 13 and more capital into crypto will be needed to push the markets higher.

“Demand continues to be steady. You have to remember that for bitcoin to stay at these levels, you need inflows of new dollars matching supply of new coins”, said Daniel Masters, chairman of U.K.-based asset manager CoinShares.

That being said, Masters anticipates most investors holding rather than selling ahead of the bitcoin halving in mid-May – with the exception of miners, who need cash to pay for operational expenditures like energy costs and data center leases.

“Analysis of wallets shows most tourists and speculators have sold, meaning we don’t expect many folks to sell into the halving except for miners who may be anticipating some pain around and are trying to lock in opex costs”, said Masters.

Crypto markets

As bitcoin remains in sideways trading and price is flat, ether (ETH) has lost less than 1 percent in the past 24 hours.

Digital assets on CoinDesk’s big board had mixed performances Friday. The biggest winners Friday include cardano (ADA), up 4.2 percent, neo (NEO), higher by 3.9 percent, and tron (TRON) gaining 2.8 percent.

Losers Friday include zcash (ZEC) off 2.9 percent, stellar (XLM) slipping 1.8 percent and decred (DCR) in the red less by than a percent. All price changes are as of 20:00 UTC (4:00 p.m. EDT).

Other markets

Oil was in the green Friday, up 1.3 percent as of 20:00 UTC (4:00 p.m. EDT) Friday after a historic week of lows in the spot and futures markets. For the past two months, the fossil fuel has actually been more volatilethan bitcoin.

Gold dipped sharply in trading Friday but recovered a bit but is still down less than a percent as of 20:00 UTC (4:00 p.m. EDT).

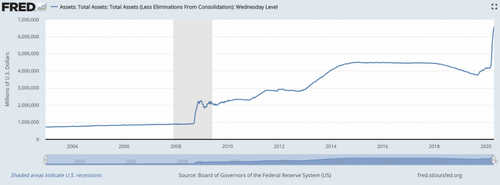

In the United States, the SP 500 index climbed 1.3 percent as Federal Reserve data recently published shows its balance sheet has jumped sharply on stimulus.

U.S. Treasury yields are all down on the day as investors jump to the safety of bonds. Yields, which move opposite to price, on the two-year fell by the most on Friday, down 4.7 percent at market close.

The FTSE Eurotop 100 index of largest companies in Europe closed in the red 1.1 percent as hopes for a coronavirus treatment from Gilead Sciences were dashed on a failed clinical trial for the drug Remdesivir.

In Asia Nikkei 225 index closed down less than a percent on news that Japan’s manufacturing output dropped and business sentiment there is at its lowest in seven years.