Now he points out that long-term holders of the cryptocurrency are fixing profits from the growth of the price of their coins right at this moment. Accordingly, the owners of cryptocurrencies that were bought several years ago are gradually selling their savings to generate income.

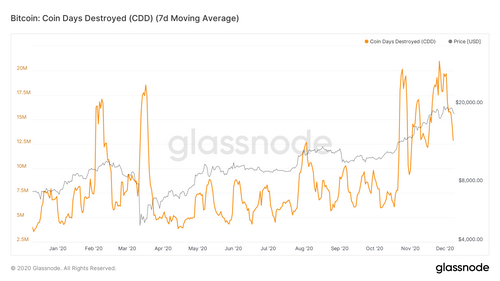

An indicator called Bitcoin Coin Days Destroyed tracks the amount and behavior of bitcoins that have been inactive for a long time.

The metric is provided by the Glassnode analytics platform. The principle of its operation is quite simple: the more coins that have been lying motionless for a very long time, have been sold on trading floors recently, the higher the indicator. It has recently started to skyrocket, meaning long-term BTC holders have started moving their coins for the first time in a very long time. Most likely, they want to sell some of them in order to take profit from the growth of BTC.

What will happen to Bitcoin in the future?

On September 26, when Bitcoin was trading at $ 10,754, Bitcoin Coin Days Destroyed only reached eight million coins. Exactly one month later – on October 26 – this metric jumped to 18 million coins. A month later, when the cryptocurrency tested its all-time high in the $ 19,800 zone, the figure rose to 21 million coins.

That is, in three months, Bitcoin Coin Days Destroyed soared by about 162 percent. This phenomenon could be the reason for the recent drop in the price of Bitcoin and the inability to finally overcome the level of 20 thousand dollars, because the more actively traders sell an asset, the more likely the price of the latter will fall, rather than rise. Unsurprisingly, long-term assets were sold just weeks after Bitcoin’s price hit its all-time high.

Bitcoin Coin Days Destroyed Indicator Change Amid Bitcoin Price

However, there is no need to worry, I am sure the founder and CEO of the BitRiver platform Igor Runets. In an interview with the news outlet Decrypt, he stated that bull run – that is, the current phase of growth in the cryptocurrency market – cannot be stopped by draining coins. Here is his quote, in which he shared his attitude to the situation and at the same time reassured investors.

I do not see this as a cause for concern for investors or bulls. Since the price of Bitcoin has set a new all-time high after nearly three years, it is natural for hodlers to consider investing, selling, or even reinvesting their BTC.

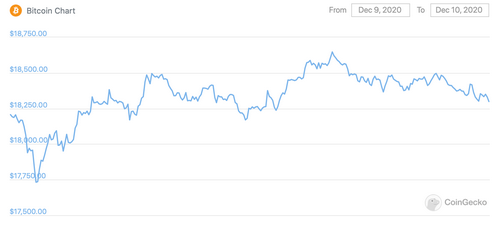

That is, the fact of selling cryptocurrency does not mean that users are parting with the world of blockchain assets forever. They could simply sell their savings in the 19 thousand zone, leave part of the profit and use the rest to re-purchase BTC at $ 17,750. Recall that BTC sank to this level yesterday.

Other analysts have even less cause for concern. Compared to January 2018, when Bitcoin collapsed seriously, Bitcoin Coin Days Destroyed was significantly higher. This feature is noted by Quantum Economics expert Jason Dean.

The indicator then grew steadily and reached a value of 85 million coins. In our opinion, the current situation is better interpreted as a positive indicator and a demonstration of confidence in the future of Bitcoin on the part of long-term cryptocurrency holders.

Indeed, selling at the level of the previous high is only a cold calculation, since the $ 19-20 thousand zone is the last resistance level before reaching new heights of the rate. In other words, some traders could buy at the peak of the rate in December 2017 and wait all this time until the price returns to its former highs. Now, investors could have dumped coins to break through – especially if they do not realize the potential of cryptocurrencies and want to tie up with a niche.

Therefore, more experienced traders could anticipate this situation, sell at the top and wait for the rate to sink. Let us remind you that the latter is indispensable at any stage of growth, including in 2017. Therefore, what is happening sounds logical.

We believe that the current situation is really not a cause for panic. It only proves that many representatives of the cryptocurrency community understand the basics of investor behavior and act proactively, while remaining profitable. As soon as the BTC rate surpasses the historical maximum, there will be no massive need to sell bitcoins. Accordingly, there will be even more reasons for growth.

In the meantime, holders have to wait for the influx of new investors into the niche. Given the increased attention to cryptocurrencies on the part of large companies, this is clearly going to happen soon.

In other words, it is not worth waiting for a serious collapse in the near future, and traders are waiting for new rate records.