Measures to combat Bitcoin mining in China are still one of the hottest topics of discussion in the cryptosphere at the moment. Nick Spanos, co-founder of the Zap Protocol platform, said in a recent interview that the government’s raid on miners only proves that Bitcoin is an «unstoppable machine. «

The PRC is doing everything to crush the network of the main cryptocurrency, but if even the second largest economy in the world cannot do it, hardly anyone will ever be able to destroy the creation of Satoshi Nakamoto.

The actions of the Chinese government in relation to cryptocurrency lovers were indeed harsh, and problems for them were created on several fronts at once. The most famous of them is the ban on Bitcoin mining in certain regions, which were previously popular with ASIC miners due to their available energy.

In addition, officials undertook to block the work of companies that are associated with transactions with digital assets. For example, yesterday it became known about the termination of the work of the Beijing Tongdao Cultural Development Co. The government became interested in the organization’s activities precisely because of «suspicions of providing software services for transactions with digital assets.»

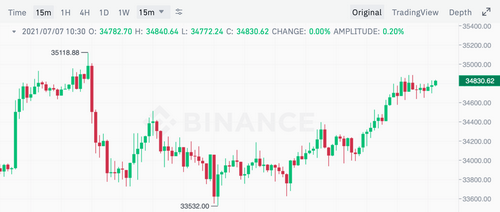

Despite this, Bitcoin and the cryptocurrency market continue to develop, which, among other things, affects the rates. For example, today BTC started the day at $ 34,830.

15 minute Bitcoin chart

The altcoin situation looks good too. In this regard, it becomes obvious that even China’s desire to create problems for cryptocurrencies in the long term will not end with anything.

What will happen to Bitcoin

Spanos noted that the government’s strategy is increasing the hashrate deficit in the network due to the fact that there are fewer miners compared to the volume of transactions. In this regard, he emphasized the increase in miners’ profits and the decrease in the complexity of the process itself. Here is a quote from an expert in which he shares his attitude to what is happening. The replica is provided by Cointelegraph.

The difficulty of mining Bitcoin is adjusted approximately every two weeks so that one block of transactions is found approximately every 10 minutes. So it has become easier and more profitable to mine BTC. That is, now even more people want to join this business.

Recall that the massive disconnection of Chinese miners from the BTC network caused a drop in the blockchain hash rate – that is, its computing power. In this regard, blocks began to be created more slowly, which is why, in general, the operation of the cryptocurrency network slowed down. This is where difficulty came into play, adjusting the ease of mining.

It fell 27.94 percent over the weekend, from 19.93 T to 14.36 T. This was the largest drop in the indicator, if you do not take into account the early months of Bitcoin’s existence immediately after the launch of the cryptocurrency. And since it became easier to mine BTC, the miners who remained on the network began to earn more. It is about this event that Nick is talking about.

Until recently, the largest share of the hashrate of the BTC network was concentrated in China.

Miners leaving China will seek to find a place for their activities in neighboring countries – Kazakhstan, Iran and Russia. This trend opens up potential additional income for the budgets of these countries. However, the government of Kazakhstan has already preferred a different tactic: the day before, the president of the state signed a decree on increased tariffs for electricity for miners.

However, Nick Spanos’s idea is unambiguous: even such a major event as the ban on Bitcoin mining in some regions of China could not harm the first cryptocurrency. Digital assets will continue to exist and perform their tasks, regardless of the attitude of officials towards them. And this is really impossible to argue with.

And while the local industry crisis is still not over, MicroStrategy CEO Michael Sailor hastened to encourage crypto investors. Recall that MicroStrategy is one of the largest holders of bitcoins, and the company has coins in the equivalent of $ 3.65 billion at today’s exchange rate.

Sailor himself is confident that the volatility of Bitcoin, one way or another, will always disappoint some traders. Here is his latest replica.

People who invest in Bitcoin as traders – and they don’t have a focus on technology or macroeconomics – will always be disappointed with the volatility of the cryptocurrency.

We have to disagree with this statement. For traders, volatility – that is, abrupt changes in rates – is the best way to make money. The faster the price of an asset changes in either direction, the higher the probability of making a profit. But from the point of view of investors, high volatility is indeed far from always viewed as a positive phenomenon. Over the past few months, Bitcoin has shown very high volatility, but within a fall.

It was unprofitable for investors, but traders were able to make money by opening short positions, that is, betting on the fall of the market.

We believe that Bitcoin has become the winner in this situation with China. The cryptocurrency network continues to operate, transactions are carried out, and value moves from one address to another. This means that the brainchild of Satoshi Nakamoto not only continues to live, but also to fulfill its functions – and to do it flawlessly.