Morgan Stanley became the first of the largest US banks to offer clients access to investment funds related to cryptocurrencies. Representatives of the bank’s management have already shared this news with top management.

Clients are offered three funds – two from the cryptocurrency firm of billionaire Mike Novogratz called Galaxy Digital and the third, created jointly by NYDIG and FS Investments. It is assumed that the innovation will become another bridge between large investors and the blockchain asset market.

Note that the desire of banks to interact with cryptocurrencies is not new. For example, in January of this year, representatives of Goldman Sachs announced a similar thing. According to sources, bankers want to create an infrastructure for storing cryptocurrencies of large clients and make money on it.

That is, in the future, less experienced users will be able to give their coins to banks for safekeeping. And this prospect seems at least amusing.

Which banks support cryptocurrencies

The minimum investment for Galaxy Bitcoin Fund LP and Galaxy Institutional Bitcoin Fund LP is $ 25,000 and $ 5 million, respectively , Decrypt reports. The minimum entry threshold for FS NYDIG Select Fund clients should be $ 25,000, but Morgan Stanley’s management will only allow clients with a bank account larger than $ 2 million to cooperate with the fund. In addition, regardless of the volume of investments, the bank’s clients will not be able to invest in the crypt more than 2.5 percent of their capital.

That is, it becomes obvious here that only large investors will be able to contact cryptocurrencies through a well-known bank. In addition, they will not be able to go all-in and invest too much in coins: 2.5 percent of the total capital will be the limit. Obviously, in this way, a financial institution insures customers against coin market volatility, that is, sharp changes in the value of its assets.

Note that against the backdrop of the recent growth of Bitcoin above 50 thousand dollars, many financial institutions are seriously interested in the potential of digital assets. However, they were outstripped by large companies like MicroStrategy and Tesla, whose volume of investments in the crypto market is already estimated at billions of dollars. It is likely that in the future, financial institutions will only expand their infrastructure around the digital asset market.

We checked the latest data: MicroStrategy and Tesla are indeed the largest holders of bitcoins among public companies. They have 91,326 and 48,000 BTC at their disposal for $ 2.21 and $ 1.5 billion, respectively. The third in the ranking is the Galaxy Digital Holdings fund – it has 16,402 bitcoins.

To get acquainted with the latest information on the cryptocurrency savings of giant companies, follow the link. Representatives of the Coingecko platform monitor the activity of such companies and their cryptocurrency investments.

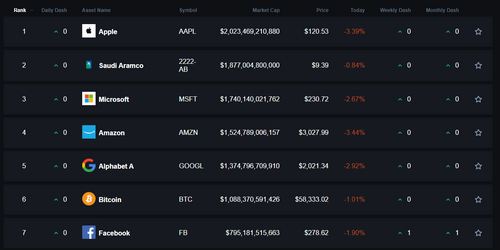

Bitcoin is the sixth largest asset, ahead of Facebook

However, not everyone in the circle of large investors shares a positive opinion about blockchain assets. A prime example of this is a recent statement by Bank of America analyst Francisco Blanche. According to him, Bitcoin is «an extremely volatile asset» and practically cannot be applied in real life. Cryptocurrency is allegedly a terrible store of capital and a poor medium of exchange, Cointelegraph reports.

Francisco Blanche

Blanche also noted the low bandwidth of the cryptocurrency. It can only process 1,400 transactions per hour , compared to 236 million transactions processed by Visa in real time. Contrary to popular belief that a fixed supply of 21 million bitcoins will inevitably lead to an increase in bitcoin price over time, Blanche argues that the price of BTC is determined by supply and demand. Consequently, the asset is entirely dependent on fluctuations in demand. In other words, even the fastest growth in Bitcoin can be «erased» by a global market correction.

Some of the problems noted are really relevant, but all of them are irrelevant at the stage of a sharp market growth. The benefits of cryptocurrency were evident long before the current bull run, and those who took them into account were able to earn huge capital until today. Critics may try to attack Bitcoin as much as they want, but the fact remains: in the long term, the main digital asset is only showing growth.

We believe that the bright contrast in the attitude towards cryptocurrencies on the part of banks confirms the youth of the industry and its huge prospects for further development. Based on previous experience, hindering technology diffusion is ultimately harmful. And above all – for those who are involved in this.