A published statement to the US Securities and Exchange Commission (SEC) showed that as of April 30, the Morgan Stanley Europe Opportunity Fund owned a stake in the Grayscale Bitcoin Trust (GBTC) worth about $ 880,000 .

Recall that the share or the so-called share in the Bitcoin Trust from Grayscale is an investment instrument, the cost of which is approximately equal to 1/1000 of the value of one BTC. That is, by investing in this trust, Morgan Stanley can profit from the rise in the price of Bitcoin without having to store the coins themselves. At the same time, now, against the background of the subsidence of BTC, the investment of the fund is going through hard times.

Grayscale Investments is currently the largest digital asset management company. Grayscale now has an estimated $ 31.5 billion in funds . In turn, Bitcoin Trust is the largest crypto fund today: its size is $ 23.16 billion. It is followed by the Grayscale Ethereum Trust with $ 6.82 billion in funds. Other funds launched by Grayscale are currently hitting the $ 3 billion mark .

Note that the format of shares in the company is very beneficial for large investors. First of all, they do not need to worry about the security of cryptocurrency storage, which in this case is provided by representatives of Grayscale. Accordingly, those who want to invest money will not have to be afraid of the activity of hackers, be suspicious of the contents of emails and do other similar things.

At the same time, there are really enough scammers in the cryptocurrency industry, which was confirmed the day before by the founder of the Binance exchange Changpeng Zhao. According to him, when Changpen follows someone on social networks, he starts a conversation with a certain text in which he warns of possible risks.

Watch out for scammers. Never send coins to «me» or anyone else without confirmation in a video call.

And since Zhao’s colleagues may well get hooked by hackers, then other people should also be careful. In this regard, it is not surprising why large investors prefer to acquire stakes in cryptocurrency trusts, rather than contacting cryptocurrencies directly.

We believe that it is safer to understand the structure of the blockchain, understand the principles of cryptography and be responsible for storing coins yourself. However, large companies would have to create a separate infrastructure for such purposes and spend a lot of resources. With this in mind, many of them are really more profitable to contact special funds.

Who invests in cryptocurrencies

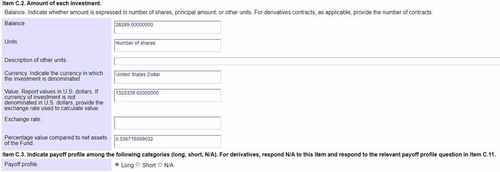

According to its monthly portfolio investment report, NPORT-P, filed with the SEC, the Morgan Stanley investment fund held at least 28,289 GBTC shares as of April 30th. At the current price at 31.13 dollars per share, this amount reaches 880,636 dollars .

At the same time, at the time of filing the document, the declared price of the shares at the disposal of the fund was estimated at $ 1.32 million, Decrypt reports. The sharp decline in the value of investments in dollar terms is due to the fall in the value of Bitcoin itself over the past couple of months.

Bitcoin Trust Investment Data

SEC filings also showed that the fund’s investment in BTC is about 0.5367 percent of its total net assets. In addition, the “payout profile” was designated as “long,” meaning the financial institution’s investments were designed for a long term. However, if the fund still retains its stake in GBTC, its investment losses reach at least 40 percent .

Given the behavior of the Bitcoin exchange rate, this is not surprising. We clarified the latest data: today BTC is trading at 33.5 thousand dollars, while the record for its value was recorded on April 14, 2021 in the 64.8 thousand zone. This is where the dollar equivalent of the Morgan Stanley Europe Opportunity Fund falls.

Daily chart of the bitcoin rate

It seems that this investment was the first attempt by the MS division to join the opportunity to earn money on Bitcoin. According to the fund’s website, the Morgan Stanley Europe Opportunity Fund «seeks to maximize capital appreciation by investing primarily in high-quality established and emerging companies located in Europe that are undervalued at the time of purchase.»

From this we can conclude that banks are smoothly joining the cryptocurrency game and trying to capitalize on changes in their prices. The decision seems logical, because now Bitcoin is even gradually recognized as an official means of payment in some countries.

We believe this news is positive for the cryptocurrency industry as a whole. And although the leaderships of banks and other financial institutions most often criticize Bitcoin and coins because of their decentralized basis, they still try to capitalize on the movements of the rates of digital assets, that is, they cannot ignore the trend.

Accordingly, if in the future a large number of customers want to interact with coins, most likely banks will also have no choice. They will be forced to meet the demand and start a deeper interaction with blockchain coins, which will eventually lead to an even greater diffusion of cryptocurrencies.