According to a blog post and social media messages, beginning on Aug. 12, Beaxy experienced a sudden surge in XRP trading volumes, with a huge sell-off reducing XRP/BTC to 40% of its price on other exchanges.

Newly-launched cryptocurrency exchange Beaxy has suspended trading after some users deliberately crashed the price of altcoin Ripple (XRP).

Beaxy launched in June this year, having already experienced difficulties after an attempt to hack its infrastructure ultimately failed to gain any funds or other data.

XRP/BTC dips 40%

“As a result and precaution, we are temporarily halting all trading activity and withdrawals across the exchange as we investigate”, the blog post reads.

XRP/BTC 3-day trade volume on Beaxy

KYC will help Beaxy track those responsible

Executives claimed the users responsible for the XRP crash can be identified thanks to the exchange’s internal Know Your Customer (KYC) procedures. Action will occur, they said, but did not specifically mention whether those involved would face legal consequences.

“We feel confident we can reclaim misplaced funds”, one of the tweets reads, adding that the suspect transactions would be reversed.

Ripple, the entity notionally behind XRP, has yet to publicly comment on the events.

The debacle comes just a week after fellow exchange and industry heavyweight, Binance, faced a publicity nightmare of its own after rumors surfaced it had lost control of its KYC data.

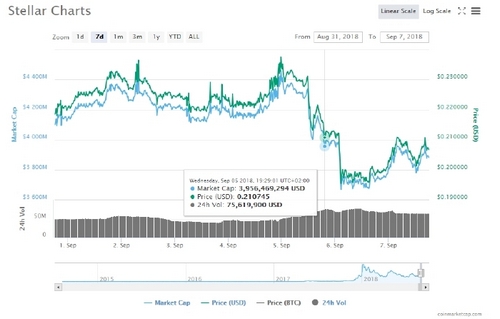

XRP Price Charts First ‘Death Cross’ Since April 2018

XRP is flashing red this Tuesday morning with a long-term price indicator turning bearish for the first time in over a year.

At press time, the third-largest cryptocurrency by market capitalization is currently trading at $0.2955 on Bitfinex, representing a 1 percent drop on a 24-hour basis. More importantly, however, the 50-day moving average (MA) of XRP’s price has crossed below the 200-day MA.

That is the first “death cross” or a long-term bearish crossover since April 2018.

Technical analysis theory considers the death cross as an advance warning of a major sell-off. In reality, however, the crossover is the result of a major price slide – the MA studies are based on historical data and tend to lag price.

This is evident from the fact that XRP fell from $0.52 to $0.28 in 3.5-weeks to July 16 and the bearish crossover has happened today.

Put simply, the long-term MA crossovers are lagging indicators and have limited predictive powers at best.

In fact, the death cross has worked as a contrary indicator in the past, as seen in the chart below.

Daily chart

XRP fell from a record high of $3.30 to $0.45 in three months to April 1, 2018, and the 50- and 200-day MAs produced charted the death cross on April 9 following which XRP picked up a bid and rose to a high of $0.96 by April 24.

Take note of the fact that the 14-day relative strength index (RSI) was reporting oversold conditions with a below-30 print on April 1. An oversold RSI indicates the sell-off is overdone and potential for a corrective bounce, which happened after the confirmation of the death cross.

This time, the RSI is hovering at 37.00 (above right). A reading between 50 and 30 indicates bearish conditions.

Further, the pennant breakdown, a bearish continuation pattern, confirmed earlier this month indicates the path of least resistance is to the downside.

Therefore, the latest death cross could end up bolstering the already bearish setup.

XRP could drop below the support at $0.2825 (April 25 low) in the short-run and extend losses toward the September 2018 low of $0.25.

The short-term outlook would turn bullish if prices rise above $0.34097 (July 20 high), invalidating the bearish lower highs setup.