The recent wave of cannabis legalization across the United States and Canada brought with it a surge in cannabis company stock prices and high hopes of big money and a thriving industry. Some also speculated legalization would curtail black market spending.

The outcome however, has been a hard comedown for many in the sector, where only the biggest players able to pay for necessary compliance measures, overhead and other fees can compete and secure funding.

Recent reports show that major marijuana companies are running out of money, and businesses in Canada are especially in danger of becoming illiquid. Major producers in the weed-friendly nation have just over 6 months of cash on hand, according to the information, and comparable companies in the U.S. just over one year of liquidity.

In the U.S. the falling cannabis stocks and sluggish market present an even greater threat, since companies cannot file bankruptcy as the plant is still illegal under federal law. All this seems to beg the question: where is crypto in these trying times?

Businesses Running Out of Weed Money, Black Market Still Thriving

Many companies have not been able to keep up with demand or establish locations convenient to their customers due to laws and regulations. As BBC News Toronto’s Robin Levinson-King reported in December:

Red tape and a cap on the number of cannabis retail outlets have made rollout slow. Retail licenses were awarded by lottery, and the province held the number of licenses at 24, to serve a population of 14.5m.

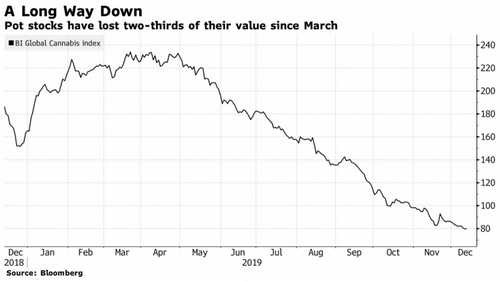

A recent article from Bloomberg, citing a report on liquidity in the industry, claims the most endangered company is Canada’s Aurora Cannabis Inc., with only 2.3 months of cash remaining. A previous report from the same outlet shows cannabis stocks tumbling since a peak in spring 2019, resulting in a scramble by companies to take cover from incoming calls on their debts.

Meanwhile, the black market is able to provide enough product, locations, and customized service to result in the majority of Canadians still preferring to use illegal cannabis.

As of December, Statistics Canada maintains that about 75% of users still use illegal marijuana, according to Levinson-King’s report. This is no surprise, really, given the inefficient nature of government central planning, but even with these dreary numbers and regulatory challenges, it seems that major cannabis companies – as well as alternative markets – could benefit from greater integration of crypto solutions. With bankruptcy proceedings for some groups already underway, one wonders what these companies have to lose by trying to target the crypto segment.

The Canna-Market Has Spoken, Prefers Decentralized Solutions

Aside from the obvious utility of crypto for purchasing marijuana on darknet marketplaces, the bitcoin and cannabis spaces have great potential synergy even above ground, in legally compliant situations. As news.Bitcoin.com reported back in September, a Berkeley City council member purchased cannabis with bitcoin cash at a local dispensary, and key benefits of crypto were discussed at the demonstration.

Assets like BCH can provide vendors a way to save on transaction fees, when customers pay with these assets in lieu of credit cards and other e-payment systems. Cryptocurrencies also help with access to banking services not provided by many traditional banks, pressured by legal restrictions to avoid businesses in the cannabis industry. With mounting bankruptcy cases, lack of banking services, and remarkable inability to meet customer demand, it seems high time lawmakers and regulators fired up a bowl of their own, perhaps, and reconsidered.

Not only do the crypto and cannabis communities share a significant cultural overlap, but in Canada and the U.S. most consumers have already voted with their money to support alternative markets, as they provide better service. Decentralized money such as bitcoin – like decentralized cannabis dealers – provides convenience and customization of the purchase process. Should governments want to get in on this cash cow, acceptance of crypto and a relinquishing of neurotic central planning of the industry seems to be a must.