It’s been almost eight months since GameStop’s stock soared in January this year. The event was significant for both the cryptosphere and traditional finance.

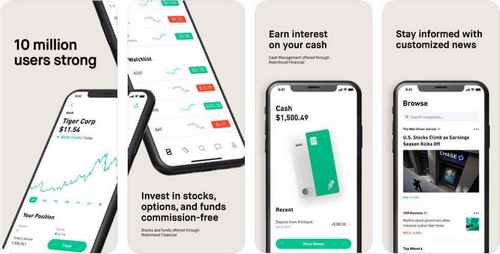

The unexpected flight of GME, orchestrated by the collective effort of the WallStreetBets community on Reddit, resulted in billions in losses among large investment funds. GameStop’s growth was accompanied by frequent trading stops in the popular trading app Robinhood, which had a significant impact on its image. Let’s talk about the outcome of the situation in more detail.

Recall that the growth of GameStop shares became one of the main news of the beginning of 2021. It was coordinated by Internet users who wanted to punish large companies that profit from the collapse of the shares of the once giant GameStop. They agreed to buy shares, thereby moving their rate up. As a result, the GME course flew to the skies, and the event ended with the victory of the common people.

At the same time, GameStop and Robinhood were not the only «heroes» of this year – the efforts of billionaire Elon Musk to increase the price of the Dogecoin altcoin should also be included in this category . All these events have shown that nothing is impossible in trading.

On the eve of the famous writer Ben Mezrich summed up the incident in his interview to the journalists of the Decrypt portal. He shared his views on the financial impact GameStop, Reddit, and Robinhood have had.

Ben Mezrich and Tyler Winklevoss

What’s going on in finance

We will remind, Ben Mezrich is known for his book «Billionaires Against Will», which was filmed in the movie «The Social Network». His new book, The Antisocial Network, describes the events surrounding GameStop and a group of traders who «were able to bring Wall Street to its knees.»

According to Mezrich, Robinhood, as one of the most popular platforms for young traders, is actually a double-edged sword. Here is his remark, in which the expert shares his attitude to what is happening. The quote is from Decrypt .

Robinhood has created an app where you can have a lot of fun. It makes Wall Street a game. There are no commissions, no long training required, and you can literally start selling and buying stocks right away. The second side of the coin is that ordinary people can also lose a lot of money if they do not follow what is happening in finance.

Billionaire Author Ben Mezrich

Although Robinhood is something of a “great equalizer” between all financiers, it still does not put individual and large traders on the same level. The latter, unlike the former, have risk hedge funds and are more experienced in their business.

The average person who invested $ 1,000 in a stock to watch it fall will not get the money back and go home to their mansion. He just lost money that should have gone to rent his apartment.

That is, the expert recommends that novice investment fans be more careful. This also applies to cryptocurrency investors who are faced with much greater volatility – that is, more noticeable changes in rates.

The dynamics of changes in the price of shares of GameStop since January 1 this year

Earlier this year, the company paid a $ 70 million fine at the behest of regulator FINRA, which found that Robinhood consistently “passed on false and misleading information” to consumers, including downplaying the risks of transactions. FINRA representatives also highlighted one sad event – the death of 20-year-old college student Alex Kearns, who committed suicide in 2020, mistakenly believing that he lost more than $ 700,000 on the platform due to options trading.

Here’s what Mezrich thinks about this.

The problem is, without any level of regulation, it’s just the Wild West. Ordinary people suffer far more than hedge funds.

Robinhood App Advertising

However, there is not only negative in Robinhood – the platform is successfully promoting financial management to the masses, that is, more and more people are becoming part of economic processes. However, they need to understand that in the end it is almost impossible to «beat» Wall Street – «the casino always wins. » Therefore, the first point to learn before working with Robinhood, and with investments in general, should be risk management strategies.

We think the GameStop situation has been instructive. First, it showed the power of Internet users who, if they so choose, can create problems for the largest investment funds. Secondly, the sharp growth and further collapse of GME traditionally ended in losses for non-professionals who did not have time to jump out of the boat in time. In this regard, they need to be as careful as possible – especially when working with cryptocurrencies. In this case, it will be possible to make money not only on paper, but also in life.