Bitcoin and Ethereum have started to show «impressive» growth precursors on many of their fundamentals charts. According to the statements of experts of the analytical platform Glassnode, all this can lead to a confident increase in coin prices in the medium term.

While the price of BTC and ETH has been moving in a fairly stable horizontal channel for a couple of weeks, it is the fundamental indicators of cryptocurrencies that can predict their explosive growth.

According to Cointelegraph, under the hood of Bitcoin and Ethereum, there is a stable accumulation and gradually growing activity in the blockchain.

What will happen to cryptocurrencies

That is, investors are gaining positions and are gradually buying up cryptocurrency. Here is a quote from analysts on this matter.

The blockchain activity of both cryptocurrencies remains relatively stable in relation to the records set at the peak of bullran. With the continued growth in the price of BTC and ETH, the bullish trends in the dynamics of the supply of coins remain in force lately.

Note that last week, experts reported a significant lag in the activity indicators of Bitcoin investors against the background of the cost of the cryptocurrency. Recall that it was then that BTC grew to $ 50 thousand, but could not gain a foothold at this price level.

Recent profitability of BTC and ETH

The number of active users of the Bitcoin blockchain deserves special attention. Despite the fact that the price of the cryptocurrency has quickly risen to $ 50K since the spring market correction , the aforementioned figure is almost 35 percent lower from its high set at the end of January. Analysts continue.

Notably, current blockchain activity is very similar to stable accumulation ahead of an explosive bullish trend. We saw something similar just at the end of 2020.

That is, experts believe that the current activity of investors will ultimately play a positive role on the prospects of the market. At least earlier, such a trend has already ended with growth.

The dynamics of active users of the Bitcoin blockchain this year

Even more information on the topic was provided by the CryptoQuant analytical platform. Its CEO, Ki Yong Joo, announced on Twitter the day before that this week, the largest number of coins was moved in the Bitcoin blockchain in a short period of time in the last two years. Joo identifies several reasons for this phenomenon: the growth of transactions in OTC trading, the movement of coins of large players due to concerns about the regulation of the crypto space, and transfers of exchange reserves.

Transfers of bitcoins in the cryptocurrency network

The management of the American mining company Genesis Digital Assets also believes in the potential of BTC: that is why the company recently acquired about 20 thousand crypto farms for mining coins. The deal was with equipment manufacturer Canaan, which gave Genesis the opportunity to purchase up to 180,000 vehicles in the future.

Genesis co-founder Abdumalik Mirakhmedov noted that the acquisition was part of the company’s strategy to rapidly expand across the United States. The new crypto farms «will significantly increase the mining center’s capabilities» and help it reach 1.4 gigawatts of electricity consumption by the end of 2023 .

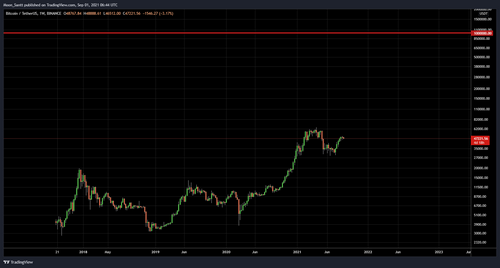

There really is a reason for such actions of miners. Kevin Wadsworth, co-founder of think tank Northstar Badcharts, said that the current bullish trend in the crypto market «will end before the end of the year,» with Bitcoin peaking at around $ 100,000 per coin. In his opinion, the price of a million dollars also does not seem so transcendental – its cryptocurrency will be able to reach already in 2025 .

In his most recent interview, Wadsworth noted that Bitcoin’s current bullish rally could end in the coming months. During this time, the BTC price will reach its new global peak. Here is a quote from an analyst.

I think the bullish trend in the crypto market is likely to end before the end of this year.

Bitcoin’s 1-week chart shows a million dollar target in red

Autumn can be a great time for coin holders, as Wadsworth expects it to rise smoothly in «September, October and possibly November. » During this period, BTC has a clear chance to overcome the $ 100 thousand mark. Some altcoins like Ethereum will grow by about 3-4 times, the expert said. Here is a quote from him on the matter, posted on CryptoPotato.

My target for Bitcoin growth is around $ 100K. Anything above will be a big bonus for the bulls. If we get to this mark, I expect altcoins, Ethereum and other coins to show at least three times the growth.

Bitcoin sellers in 2025

Wadsworth is very confident in his prediction: in an interview, he noted that the share of Northstar Badcharts success in such predictions reaches up to 95 percent. He expresses no less optimism about the announced mark of one million dollars for BTC in 2025. True, in the short term, for the start of rapid growth, the cryptocurrency must gain a foothold above 51 thousand dollars. If she does not succeed in the near future, analysts recommend being ready for a BTC correction.

Let us note once again that the point of view of some analyst does not guarantee anything in the future. Accordingly, Wadsworth’s prediction may simply not come true and turn out to be wrong. Therefore, we traditionally recommend investing any funds only after conducting your own market analysis. Thus, it will be possible to take responsibility for investment decisions and at the same time gain more confidence in the further development of the niche.

We believe that the current climate in the cryptocurrency industry is indeed favorable for further market growth. At least the May collapse probably led to the formation of the bottom of the coin rates, which is unlikely to fall below which it will be possible. However, investors and traders cannot relax anyway and should be prepared for any scenario. This implies the use of risk management tools like stop-losses and the opening of positions at comfortable sizes.