A cryptocurrency enthusiast under the pseudonym Joe-M-4 posted on Reddit the results of his experiment with cryptocurrencies, which he began on January 1, 2020.

Recall that an investor invested $ 1,000 in the top ten cryptocurrencies by their market capitalization, that is, the product of the rate by the number of coins in circulation. By January 1, 2021 – exactly twelve months later – the investor has recorded the results and has now shared the results of his idea.

The essence of the cryptocurrency hobbyist’s experiment was simple. He wanted to find out in practice whether investing thousands of dollars in top coins could bypass more traditional investment vehicles. In addition, he went the relatively simple route and invested $ 100 in each of the ten largest-cap coins. Note that some cryptocurrencies outside the top ten showed much more impressive growth – and in a shorter time frame. However, the user wanted to simplify the task and therefore did just that.

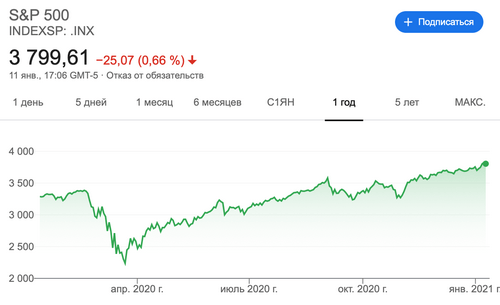

At the same time, the S P500 index includes five hundred companies with the largest capitalization, which are traded on the US stock exchanges. He is in serious demand. To illustrate: at the end of 2020, Tesla was included in the index.

We checked the actual data: today the rating of the top ten cryptocurrencies is as follows.

In addition, we found archived data. In particular, on January 5, 2020, the top of the overall coin rankings was like this.

Is it profitable to buy cryptocurrency

The results of the experiment were outstanding: the investment portfolio Joe-M-4 grew by 139.47 percent to $ 2,395, according to Decrypt. During the same period, the SP 500 stock index showed growth «only» by 16 percent.

It is important to note that the experiment was limited exclusively to 2020. However, the sharp rise in Bitcoin and other cryptocurrencies began in 2021. If on January 1 of this year BTC was valued at 29 thousand, then on the eighth it set its current price record at $ 41,940. Accordingly, the investment of the coin lover has become even greater.

Here is a chart of the Bitcoin price for the last month.

Joe-M-4 performed the same experiment back in early 2018 and 2019. True, in the year before last, the cryptocurrency portfolio failed to overtake the SP 500 in terms of profitability, although the cryptocurrency market capitalization increased over that period by at least 67 percent. In other words, in 2019, the cryptocurrency market grew due to altcoins with a relatively low capitalization. Results: 2 percent portfolio growth compared to 29 percent for the SP 500.

The results of 2018 were much worse – the portfolio fell by more than 85 percent by one thousand dollars, as this period fell right in the middle of the bearish trend in Bitcoin. By comparison, the SP 500 was down only 6 percent for all of 2018.

Of the ten cryptocurrencies Joe-M-4 invested in last year, only seven are still on the list of the ten largest digital assets by market capitalization. EOS, Bitcoin SV and Tezos dropped out of the top 10. Tezos fell the most, the cryptocurrency now occupies the twentieth place in terms of capitalization. These altcoins have now been replaced by Chainlink, Cardano and Polkadot.

It is also worth noting that an investment in Bitcoin or Ethereum alone would be even more profitable. At the moment, the growth of the BTC rate over the past year is 356 percent.

At the same time, Ethereum has increased in price by 707 percent over the year.

We believe that this experiment perfectly demonstrates the «volatility» in the top 10 coins: if in one period a project is considered a favorite, then after a year its price and capitalization are rapidly falling. Only Bitcoin and Ethereum remain unchanged industry leaders, so for now they are best suited for the role of long-term investments.

Despite the changes in the top ten cryptocurrencies, they were able to bypass one of the main traditional investment tools. We think this confirms the potential of the industry for investors – at least in the near future. Obviously, dealing with coins at the stage of a fall in terms of short-term profit is not a good idea, but in the end it was perfect for accumulation, that is, buying cryptocurrencies at lower prices in order to grow after a few years.