Compared to January 1 of this year, fees on the Ethereum network have skyrocketed by at least 400 percent. This growth not only forced traders to bear higher costs on their ETH transfers, but also scared them away from using cryptocurrency.

At the same time, coin miners are actively extracting profit from this situation. According to analysts at Glassnode, their daily profit from commissions alone reached $ 898 million. ETH mining demonstrated such a high profitability back in January 2018. We understand the situation.

We checked the actual data: today Ethereum ETH is trading at $ 1,033, which is almost the same as the value of a day ago. With a market capitalization of $ 117 billion, the trading volume in the last 24 hours was equal to 60 billion.

Note that over the past fourteen days, ETH has jumped 69 percent. Yesterday, the value of the asset for the first time since February 2018 broke through the level of $ 1,000. This forced the more experienced traders to take profits and the beginners to enter the position. As a result, the network began to be actively used, which, given the limited bandwidth, resulted in a sharp increase in commissions.

Yesterday, the average cost of a regular transfer on the Ethereum network almost reached the equivalent of $ 16. At the same time, in Bitcoin, you had to pay about $ 9 for sending.

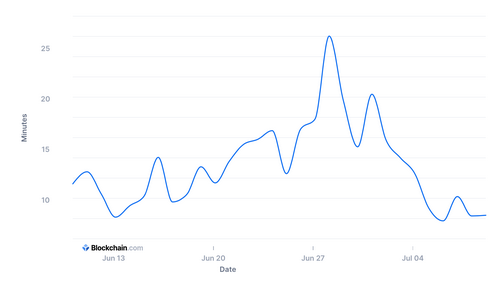

How much does it cost to send ETH

As a reminder, the gas charge, which determines the final cost of a transaction on the Ethereum network, is constantly changing. It increases as the demand for the network grows. Higher gas fees indicate increased demand on the network and also make the cryptocurrency itself hardly usable for everyday use. In addition, the ecosystems within Ethereum «suffer» from this.

Most of all, traders on decentralized exchanges felt the change. For example, blockchain lover Matthew Finestone cited sad statistics from the Uniswap trading platform. On it, the value of the average trade reached a threshold of $ 47, Decrypt reports.

At the same time, yesterday we were faced with the need to pay the equivalent of $ 160 for the exchange on the said decentralized exchange. In this case, the total amount after the swap was $ 120.

According to Etherscan.io, the «upper threshold» for gas payments is also rising. This is the upper range of fees that traders pay for the fastest confirmation of transactions. On January 1, 2021, it was about 240 gvei, and the day before, the figure rose above 700 gvei. Recall that gvey is the smallest piece of the ETH coin, which measures the cost of gas in dollar terms.

One of the reasons the Ethereum network suffers from higher fees is the growing popularity of the Decentralized Finance (DeFi) niche, which is mostly powered by the ETH network. Alex Svenevik, CEO of analytical platform Nansen, shared his own experience of working with Ethereum in such «difficult conditions». He had to pay $ 23 in commission to approve the pair with the new cryptocurrency and another $ 83 per transaction.

As a result, Ethereum users paid the equivalent of $ 20.73 million per day. This is almost six times the result of Bitcoin. Accordingly, users are willing to pay big bucks to interact with the blockchain.

It is worth noting that Ethereum users are looking forward to implementing tier 2 scaling – solutions that will take user transactions from the main cryptocurrency blockchain to an additional tier. They will improve the user experience and unload the coin network. Also, after the activation of Ethereum 2.0, the network bandwidth will grow to thousands of transactions per second, as a result of which the problem of incredible fees will become a thing of the past.

Today, fees on the Ethereum network have dropped and returned to a relative norm. Here is the latest data from the ETH Gas Station version.

We believe that these high commission situations prove the importance of the Ethereum network to users. That is, they are ready to pay big money for transactions, even though there are enough blockchains in the cryptocurrency niche with significantly lower fees. So they see a lot of sense in this.

Apparently, this will continue in the future. Although the situation should be corrected by the implementation of EIP-1559