In January, cryptocurrency exchange Coinbase officially announced plans to go public. It ditched its traditional IPO in favor of a direct listing of shares (DPO). Coinbase will be listed on the Nasdaq on April 14.

The wave of IPOs in the cryptocurrency market is considered by some to be a harbinger of the end of a bullish rally, but the direct listing of Coinbase is certainly a landmark event for the entire industry.

The history of Coinbase began in 2012, when the developer of the startup Airbnb, Brian Armstrong, posted on Reddit a message about the prototype of a cloud-based bitcoin wallet. This message came across Fred Ersam, a trader at the investment bank Goldman Sachs, who traded cryptocurrency in his spare time.

A conversation ensued between the young people, during which it turned out that the development of the project had already been completed and he became a member of the Y Combinator incubator. After a personal meeting, Armstrong invited Ersam to join him as a co-owner of the company.

Five years later, Coinbase became the first «unicorn» of the cryptocurrency industry, and the company’s last known valuation was $ 8 billion (in October 2018).

In 2021, her stock market debut could be the largest listing for U.S. tech companies since Facebook and the first major DPO on the Nasdaq.

- Coinbase will be listed directly on the Nasdaq under the ticker COIN on April 14. The Exchange refused from the additional issue and will issue 114,850,769 Class A shares.

- The company has created an ecosystem of services: wallet, Coinbase Pro and Coinbase Prime exchanges, Coinbase Commerce processing, Coinbase Custody, Coinbase Card debit cards, Coinbase Earn education service, USD Coin stablecoin and Coinbase Ventures venture capital arm.

- Coinbase’s revenue for 2019 was $ 483 million, for 2020 – $ 1.1 billion, and for the first quarter of 2021 – $ 1.8 billion.

- The largest beneficiaries of the listing are Andreessen Horowitz, Union Square Ventures and Ribbit Capital, as well as co-founders Brian Armstrong and Fred Ehrsam.

- Expected capitalization on the day of direct listing – $ 100 billion.

Coinbase Ecosystem

Coinbase is a platform for buying, selling, transferring and storing digital assets, which calls for its mission to create an open financial system. The company is developing several business lines.

The Coinbase.com platform and wallet are designed to buy, sell and store cryptocurrencies.

For individual traders, the company offers an exchange with advanced functionality Coinbase Pro, for institutional clients – Coinbase Prime. Both products provide funds insurance.

Exchange activity is Coinbase’s core business, however it has other commercial products as well. Coinbase Commerce provides online retailers with software that allows them to accept cryptocurrency payments.

To securely store digital assets for institutional investors, the company offers a custodian service regulated by the New York State Financial Services Authority (NYDFS).

Coinbase Custody supports over 100 assets that account for over 90% of the total cryptocurrency market capitalization. As of December 31, 2020, Coinbase managed $ 90 billion in assets, with over 50% of these assets held by Coinbase Custody.

In the summer of 2019, Coinbase Custody acquired the institutional business of another custodian service, Xapo. The deal was valued at $ 55 million.

In partnership with blockchain company Circle, the exchange founded the Center consortium. The organization is the issuer of the USD Coin (USDC) pegged stablecoin and is developing its ecosystem. At the end of March 2021, the Visa payment system launched a pilot program to integrate payments in USDC in its network.

Together with Visa, the exchange also issues debit cards that allow you to pay for goods and services using digital assets.

Coinbase has a venture capital arm that invests in early stage cryptocurrency and blockchain startups.

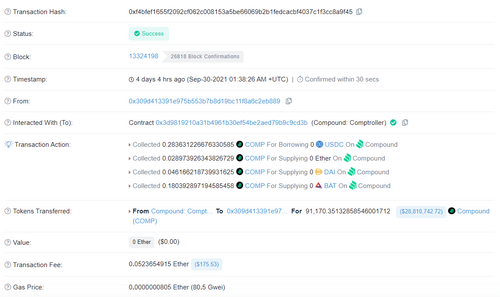

Coinbase Ventures has 68 startups in its portfolio, including BlockFi and Compound, according to Crunchbase. The division acted as a lead investor in four rounds of funding and carried out exits from two startups – Curv and Elph Network. According to Messari, Coinbase Ventures has 22 cryptoassets in its portfolio.

In January, Coinbase acquired digital asset market infrastructure provider Bison Trails. The deal will allow the exchange to enter the IaaS (infrastructure as a service) market. Bison Trails continued to operate as an independent company.

Most of Coinbase’s income comes from fees charged for buying and selling bitcoin and other assets. Coinbase Pro and Coinbase Prime operate on standard maker-taker fee structures.

The company does not charge a fee for accepting payments through Coinbase Commerce, however, if a customer wants to convert digital currency to fiat currency, they will have to pay for it.

Coinbase Custody charges a fee for storing cryptocurrencies and a one-time implementation fee.

Coinbase financial performance

The Coinbase Application contains information about the state of the business and the risk factors that may affect its development and upcoming listing.

2020 was a good year for the exchange: in 12 months the company earned more than $ 1.1 billion, which is 136% more than in 2019, when revenue was $ 483 million.Coinbase’s net profit in 2020 was $ 322 million.

The growth in revenue is closely related to the increase in trading volume – between 2019 and 2020, the indicator grew by 142%. Almost all revenue (96%) came from commission fees, the value of which correlates with the activity of the digital asset market.

Institutional deals were the main drivers of growth in Coinbase’s earnings during 2020:

- in the first quarter of 2020, the volume of institutional trading increased six times compared to the same period in 2019;

- in 2020, this figure increased from $ 18 billion in the first quarter to $ 57 billion in the fourth quarter;

- over the same time period, retail traders’ trading volume increased from $ 12 billion to $ 32 billion.

Bitcoin accounted for 41% of the trading volume. Ethereum became the second most popular cryptocurrency, accounting for 15% of trading.

Investment in «technology and development» is one of Coinbase’s largest expenditures, accounting for 21% of total revenues. Above are only the “general and administrative” expenses, which account for 22% of the revenue.

As of the end of 2020, there were 43 million verified retail customers and 7,000 institutional members registered on Coinbase exchange services. The monthly number of active users of the exchange was estimated at 2.8 million.

A week ahead of the upcoming listing, Coinbase released estimated financial results for the first three months of 2021:

- the company’s revenue for the reporting period is estimated at $ 1.8 billion, net profit – from $ 730 to $ 800 million, adjusted EBITDA – $ 1.1 billion;

- the quarterly trading volume is estimated at $ 335 billion;

- Coinbase manages assets worth $ 223 billion, which is 11.3% of the total market capitalization, including $ 122 billion in institutional clients’ assets;ъ

- the number of verified users of the platform has grown to 56 million, the monthly number of active users is estimated at 6.1 million.

The company expects that in the best-case scenario in 2021, the average number of customers who make transactions at least once a month will be 7 million. In the worst-case scenario, it will be 4 million.

Coinbase also announced that by the end of 2021, the total volume of its investments in technology and development, as well as expenses for general and administrative needs, could reach $ 1.3- $ 1.6 billion. This is due to the fact that the company is with further scaling. The exchange also plans to increase marketing costs – they can range from 12% to 15% of net income.

IPO vs DPO

Unlike an IPO, a direct listing assumes that the shareholders of a company directly sell securities to investors. Until recently, it was not possible to issue additional shares under the DPO, but in December last year, the US Securities and Exchange Commission (SEC) lifted this restriction.

Direct listing allows you to save on underwriting fees and avoid the restrictions associated with a traditional IPO. However, in addition to the advantages, this procedure also has significant drawbacks – the company is deprived of the guarantees and protection that are provided by intermediaries.

Coinbase will list 114,850,769 Class A shares, which will be traded under the ticker COIN. The company did not use the opportunity to carry out an additional issue of securities. The bid did not specify the price range for the placement, however, in the first quarter until March 15, the weighted average price of shares in the secondary market was $ 343.58.

By the time the material was prepared on the FTX derivatives market, the price of futures contracts, the execution of which is associated with the market value of Coinbase shares as of the end of the first trading day, reached $ 486. Based on the fact that FTX futures tracks Coinbase’s market cap divided by 250 million shares, traders value the exchange at $ 121.5 billion.

Largest Listing Beneficiaries

Coinbase has split its shares into Grade A and Grade B shares, which give holders identical rights with the exception of voting and conversion rights. Each Class A ordinary share gives the holder one vote. A Class B common share carries 20 votes and can be converted to Class A paper at any time. Thus, the holders of the outstanding Class B shares together hold 99.2% of the voting rights.

As of the filing date, Coinbase’s largest institutional shareholders were Andreessen Horowitz (14.1% of voting rights), Union Square Ventures (8.1%) and Ribbit Capital (7%). Coinbase’s equity also includes venture capital firms Paradigm, Tiger Global, and Viserion Investment.

Coinbase’s largest private shareholders are its founders Brian Armstrong and Fred Ehrsam, as well as the commercial director of the exchange, Surojit Chatterjee. The founders own 21.6% and 8.9% of the voting rights, respectively, Chatterjee owns less than 1%.

In August 2020, Armstrong received 9.3 million options to buy Coinbase stock at $ 23.49. If, after listing, the value of the shares is close to their weighted average price in the secondary market, he can count on income of more than $ 2.9 billion.

New Netscape

Some expect Coinbase to repeat the story of Netscape Communications Corp., whose IPO is considered to be the starting point of the dot-com boom. Armstrong’s company will be the first publicly traded cryptocurrency exchange, and this event will certainly impact the entire industry.

Coinbase’s listing application showed that the company has a solid business model that is already profitable. The exchange has a huge verified user base, which is extremely important for regulators.

Coinbase has always stated that one of the key points of its strategy is working with regulators. For example, the exchange avoids listing confidential assets like Monero.

Since listing on the stock exchange is subject to strict disclosure requirements, Coinbase will take a big step forward in its quest to please regulators. The very fact that the SEC approved the exchange’s application already suggests that the Commission no longer perceives business in this area as located in the gray zone or toxic.

Going public with Coinbase shares will provide investors with yet another tool to indirectly invest in digital assets. Since the vast majority of the exchange’s income comes from commissions, its shares are likely to have a high correlation with trading volumes in the cryptocurrency market.

Investors have already made it clear that their interest in Coinbase is quite high – to be convinced of this, just look at the dynamics of trading in private markets. So, on the Nasdaq Private Market in February, quotations rose to $ 375 per share. However, the associated risks should not be overlooked.

What could go wrong?

In short, a lot. Coinbase’s long-term success depends largely on whether the company succeeds in achieving its mission of restructuring the global financial system. And this goal is accompanied by a long list of risk factors, the most significant of which are resistance from a cohort of monetary regulators, loss of public confidence in cryptocurrencies and possible losses due to volatility in digital asset prices.

In a letter attached to Coinbase’s application, Armstrong writes about financial standards that «no company or country can manipulate.» However, many states, especially the United States, whose dollar has the status of a reserve currency, are not interested in relinquishing control over monetary policy. Therefore, in the near future, cryptocurrencies may face tightening regulation – this is also noted by Coinbase itself.

The sources of the exchange’s income depend on the state of the cryptocurrency market, or, more precisely, on the activity of traders and the trading volume. Long periods of calm or so-called “crypto winters” can significantly affect Coinbase’s position.

The company also cites competition from the decentralized finance (DeFi) sector and the disclosure of Satoshi Nakamoto’s identity as risk factors. Coinbase did not specify how it would be affected by the possible identification of the creator of bitcoin, but noted that its business could suffer if the exchange cannot withstand competition from decentralized and non-custodial platforms.

Beyond that, more traditional factors also affect Coinbase’s business. For example, since the exchange earns part of its income from interest for placing fiat funds deposited by customers in deposit bank accounts, low interest rates negatively affect the company’s business.

Coinbase writes that the development of mining-related technologies, as well as the consolidation of capacity in a small segment of large pools, could «reduce the security of the blockchain and the attractiveness of cryptocurrencies.» This could lead to the loss of public confidence in the digital asset class.

To be sure, Coinbase has proven its ability to make money. The exchange has a large user base that can still grow, since one of the key provisions of its growth strategy is international expansion. It also works with the largest payment card player, and is used by companies such as Tesla, MicroStrategy and One River.

However, over the long haul, Coinbase’s success is closely tied to the success of the cryptocurrency industry. The exchange emphasizes that the future development and growth of this market depends on many factors that are difficult to predict or assess.