Over the past few months, the Bitcoin chart has moved almost along a parabola and even managed to gain a foothold above the previous all-time high set in 2017 for a while.

Given the high interest of large investors in bitcoins, in October and November, altcoins received quite little attention from market players. Yes, many coins have grown in value, but even this growth cannot be compared in scale with the «altcoin seasons» that have been in the history of the crypto market. Why does this happen and what are the peculiarities of the viola’s behavior?

Considering that now Bitcoin is «marking time» just a step away from the line of 20 thousand dollars, the quite expected question comes to mind: what to expect from the dependence between BTC and all other coins?

Let’s take a look at the main premises and signs of the start of the supposed «altcoin season». That is, we will find out what affects the growth of «alternative» cryptocurrencies, and how they relate to the behavior of Bitcoin.

BTC dominance growth

First of all, you need to pay attention to the level of dominance of BTC. This metric characterizes the share of Bitcoin in the total market capitalization. Since mid-October, the dominance rate of the main cryptocurrency has hovered between 59-62 percent since early October, according to CoinMarketCap. Before that, market players earned on the euphoria around the sphere of decentralized finance, which was also marked by a fall in the level of BTC dominance below 58 percent.

Since the Bitcoin halving in May this year, the cryptocurrency has grown relatively slowly with periods of low volatility. At this time, altcoins dominated the headlines in crypto news. In particular, the field of decentralized finance has been the main source of profit for most crypto traders. From June to August, traders made monthly profits from alts, bringing Bitcoin’s dominance rate to below 60 percent for the first time since the start of the year.

The euphoria around altcoins was short-lived, as in September a lot of bears appeared on the market, that is, those who like to make money on the fall in coin rates. Since mid-September, Bitcoin has regained its dominance in capitalization. At the time of this writing, this figure hovers around 63.5 percent, while all altcoins occupy 36.5 percent of the market.

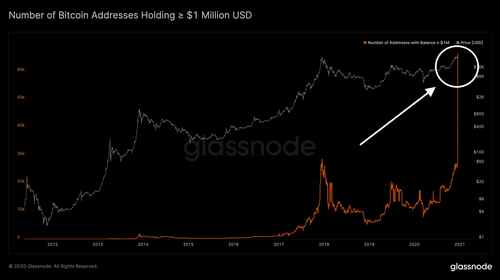

The growing dominance of Bitcoin has followed a rise in investor confidence in it, especially among institutional players. In the fall, corporations like Microstrategy and Square acquired bitcoins as their treasury asset. In addition, payment platform Paypal announced its decision to integrate cryptocurrencies, allowing millions of its customers to buy and sell bitcoins.

And even negative news, such as accusations against the management of the major trading platform BitMEX and problems with withdrawing funds from OKEx, did not shake the strong bullish movement of the main digital asset. The number of whales, that is, large investors with at least 1000 BTC in their account, continues to grow. This is a positive sign as this trend is reducing the circulating supply of coins in the market, potentially dampening any bearish sentiment.

Weakening the correlation of Bitcoin with altcoins

Since mid-September, Bitcoin’s profitability metrics have become less influential on altcoins. Although the entire crypto market has blown away after short bearish activity, Bitcoin has emerged as the “safest” large-cap asset for this period.

While altcoins may lag behind growth cycles, trading history shows that altcoins will eventually catch up. The correlation between Bitcoin and the largest altcoins by capitalization fell on October 20 as Bitcoin surged above the range. This indicates the rotation of capital between altcoins towards Bitcoin during this period.

This is all wonderful, of course, but what should investors in coins do besides Bitcoin if it suddenly starts to suddenly grow again? Hence the question: why is the price of altcoins falling while Bitcoin is setting new highs?

Market movements and herd sentiment

People often invest irrationally, that is, based on psychological biases, not market principles. When the price of a particular coin rises or the overall demand in the market rises, they go long. When a cryptocurrency rises noticeably in price – say, by 20 or 30 percent – investors tend to overestimate its future expected value and are afraid to sell the crypto «too early».

This behavior is so common that it even affects the prices of individual cryptocurrencies, causing disproportionate up and down movements.

This phenomenon is still widespread in the crypto market. As the price of Bitcoin begins to move rapidly, traders hope to capture every bit of that momentum. Hence, they are transferring capital from altcoins to BTC. Such «swing» leads to high volatility of the alts, from which you can successfully profit.

It is important to note here that with the growth of Bitcoin, cryptocurrencies that are traded in pairs with BTC suffer most noticeably, because this allows traders to go to the exchange and exchange coins for bitcoins. If some new cryptocurrency is not trading against BTC, it can quite easily survive both the rise and fall of the main coin of the market.

This effect is similar to how traditional foreign exchange markets work. Let’s say the US dollar starts to rise. If you want to make quick money, you will have to convert your local currency into US dollars in order to sell them and get more local money.

Imagine that all market participants are simultaneously investing in the US dollar. This behavior can significantly affect both the base and quoted currencies. In traditional foreign exchange markets, when the US dollar strengthens / weakens, other currencies like the euro, Australian dollar or Canadian dollar move in the opposite direction.

It’s the same with cryptocurrencies. When there is an imbalance in demand for bitcoins, it can significantly affect altcoins as well.

Increased adoption of cryptocurrencies

Regardless of your opinion on Bitcoin, you cannot deny that BTC is by far the most popular cryptocurrency. It is the largest cryptocurrency by market cap at $ 358 billion as of December 15, 2020. Meanwhile, Ethereum – the second largest cryptocurrency in the industry – has just over $ 66 billion in capitalization, which is almost one-fifth of the amount of bitcoins mined to date.

This is the absolute dimension of the reign of Satoshi Nakamoto’s creation. In fact, people who are not associated with the crypto market often associate cryptocurrencies with «bitcoins» or even confuse all coins with them. To this day, Bitcoin continues to be the yardstick by which all other cryptocurrencies are measured. Especially recently, when large financial institutions are fighting over an already scarce cryptocurrency.

Several well-known investors, such as Paul Tudor Jones, have publicly expressed their optimistic views on BTC, further promoting the popularization of the leading cryptocurrency. So when new money comes into the market, it is likely that new investors will invest their money in the cryptocurrency they have heard the most about, namely Bitcoin. He is still the king of the industry and is unlikely to be overthrown anytime soon.

With this information in mind, you should learn how to properly use the market cycles of the industry. When Bitcoin is growing steadily, this indicates the flow of large capital into the cryptocurrency. Typically, these jumps in price quickly turn into accumulation phases when the value of the asset moves in a horizontal channel. As practice shows, at such moments it is best to bet on alts, which again attract investors after a «respite» in the BTC bull run. After all, investors and traders are always looking for an opportunity to make money. And if Bitcoin doesn’t move, their focus shifts to other coins.

However, it is important to remind here that any investment decisions must be made independently. Moreover, events in the past do not at all guarantee that the same will happen in the future. However, although history does not repeat itself, it often «rhymes» with the past development of events.