Note that Ethereum is not doing well today, as is the cryptocurrency market as a whole. Over the past 24 hours, the ETH rate managed to drop by 9.2 percent and reach the level of $ 534. The cryptocurrency then recovered to the $ 564 level.

As a result, the daily drawdown was only one percent.

Benjamin N. Cardoso School of Law professor Aaron Wright believes in Ethereum’s victory over Wall Street.

According to him, the second largest cryptocurrency by capitalization will completely revolutionize the state of affairs in the world of traditional finance in the next ten years. Wright outlined three key reasons why Ether can compete with the traditional financial sector: decentralized autonomous organizations (DAO), non-fungible tokens (NFT), and support for various tokens.

The ETH chart for the last month looks like this.

Reasons for Ethereum’s Growth

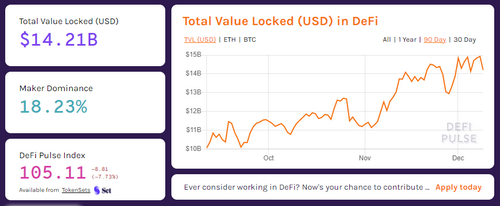

The main trend of 2020 can definitely be called the rapid development of the field of decentralized finance (DeFi). In just a few months, $ 14.21 billion in injections appeared in popular DeFi protocols. At the same time, the total capitalization of coins from this area reached $ 18.8 billion.

Amount of funds blocked in DeFi protocols at the moment

This means that network participants are not only interested in the development of new technology, but are also ready to actively invest in it. At the same time, for many investors, the investments turned out to be successful: in the summer, the rates of new representatives of the DeFi niche increased tenfold in a matter of weeks.

But Ether is not only about decentralized finance. Wright is confident that in the future, DAOs, NFTs and a variety of tokens will also find their place in the sun in the cryptocurrency ecosystem. Here’s a quote from CryptoSlate.

DeFi does not compete with Wall Street, but Ethereum is quite claiming for this role. Over the next 5-10 years, this area could eat: Silicon Valley with DAO, art / games market with NFT, and social media with personal tokens.

By the way, the second point of his argumentation deserves special attention. Unique tokens based on Ethereum are increasingly featured in cryptocurrency news: it is quite possible that this phenomenon will become especially popular in the new 2021.

Since the Ethereum network is highly secure and allows the creation of tokens, the uniqueness and originality of which are easy to verify, it is in demand in the current trend of digital art. Artists and other creators create unique works and sell them for serious money.

In particular, this work was sold for $ 25,000.

Digital work sold for $ 25,000

At the same time, DAOs could be at the center of the next phase of Ether growth, as this concept can be adapted in many different ways. Basically, the DAO is a decentralized organization. DAO members can vote on decisions in accordance with the size of the invested funds and thus develop regardless of external factors. Usually, representatives of the organization vote on which project will receive financial support in the form of investments.

A DAO can be a foundation, project, or community. Typically, the DAO has a base token called a governance token. With it, members of the organization can vote to approve proposals. For example, DAO can be used in a venture capital fund. In a DAO-based fund, management token holders will be able to dictate the fund’s operations. If these decentralized governance systems are applied in both the financial and non-financial sectors, it could significantly improve the usability and adoption rate of Ethereum.

Note that at one time it was the DAO hacking that caused the formation of disagreements in the Ethereum community and the creation of Ethereum Classic. Read more about the situation in a separate article.

Ethereum and other cryptocurrencies

Finally, the final milestone in the expansion of the Ether ecosystem will be the completion of the upgrade to Ethereum 2.0. DeFi’s earlier explosive growth was slowed down by the low bandwidth of the cryptocurrency and, as a result, very high fees. With the transition to Proof-of-Stake, this problem will be resolved. Although the full completion of the update remains to wait for about two years.

We think the professor’s comments are really very important. They make it clear that the main cryptocurrency network after Bitcoin has tremendous potential to change the world. The niche of decentralized finance will allow the niche of decentralized finance to compete with banks, and decentralized exchanges will come in handy for trading without restrictions.

At the same time, the directions of unique NFT tokens and digital art are also developing in the blockchain, and the DAO will provide an opportunity to invest in new projects.

Therefore, the prospects for Ethereum really seem incredible. Especially when developers increase the bandwidth of the network and allow it to handle thousands of transactions per second.