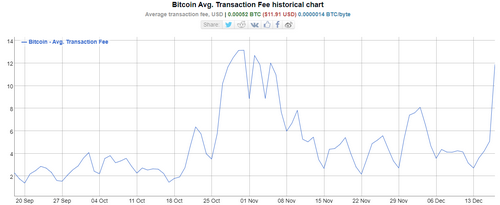

Bitcoin transaction fees have quadrupled since last Sunday, according to BitInfoCharts. If a week ago the average BTC transfer would have cost $ 2.7, then the day before this figure jumped to $ 11.9.

This is an increase of hundreds of percent in just a few days. Let’s see what is the reason for what happened.

Recall that for adding each transaction to the Bitcoin block, you need to pay a commission to the miners. The higher this commission, the higher the likelihood that your transfer will be among the first from the mempool. A mempool is a queue of unconfirmed transactions to be added to a block.

Everything is logical here: it is most profitable for miners to process transactions by the size of commissions in descending order. Yet commissions affect their total income, and the higher the numbers, the higher the interest.

In turn, the need to pay high costs for transfers arises from the technical limitations of the Bitcoin network. The latter is able to cope with no more than seven transfers per second, and this figure cannot be increased. Accordingly, users are forced to fork out if they don’t want to get stuck in a pool of unconfirmed transactions.

How much does it cost to transfer bitcoins

According to Tim Ogilvy, CEO of Staked platform, the reason for the recent surge in fees is the increased demand for Bitcoin following the rise in the price of the cryptocurrency. Ogilvy connects the achievement of a new all-time high in value with a strong desire by crypto enthusiasts to transfer coins, Decrypt reports.

Graph of changes in the average commission in the Bitcoin network for the last three months

This opinion is shared by Denis Vinokurov, head of the research department of digital assets of the broker Bequant. In his speech, he recalled the basics of the network, which, among other things, affect the cost of translations.

Higher activity in the cryptocurrency network leads to higher commissions and, as a result, congestion of this very network. The sharp increase in the number of daily transfers is a prerequisite for an increase in the size of the average commission. This is similar to what happened with Ethereum and the DeFi realm. As the latter exploded in popularity, the cost of gas on the Ethereum network also skyrocketed.

The explanation for the demand for Bitcoin is very simple: the cryptocurrency has set a new price record. This means that some of the crypto enthusiasts take profits – they transfer coins from wallets to exchanges and sell them. The other part, on the contrary, counts on the long-term continuation of bull run and transfers coins from exchanges to wallets.

Another way to gauge activity is to look at the rapidly growing trading volumes on exchanges. On December 13, when Bitcoin was priced at $ 18,773 and transaction fees reached $ 2.7, daily trading volumes in BTC pairs were $ 23 billion. Now, when its price has already exceeded the $ 23 thousand mark, the volumes reach $ 48 billion.

It is possible that this is only one of the small peaks in the growth of fees on the Bitcoin network. If the price of a cryptocurrency ever hits the $ 100K mark, that figure will be much higher. At least due to the fact that the final volume of commissions is formed in satoshi, which means that the higher the BTC rate, the more the dollar equivalent of the transaction cost will be.

We have checked the actual data on other networks. Ethereum users need to pay significantly less for the transfer, since the network bandwidth is higher. And although the trend of changes in the cost of transactions resembles the situation with Bitcoin, the day before the transfer cost an average of $ 5.3.

We believe that the situation with the growth of commissions in cryptocurrency networks was quite predictable, because the more people conduct transactions, the more expensive you have to pay for transfers. Note that while the indicators are far from their intermediate peaks. In particular, in Ethereum on September 2 this year, an average of $ 14.5 had to be paid for one transfer. Then there was incredible activity on the network against the background of the free distribution of UNI tokens from the Uniswap decentralized exchange.

So while the situation with the rates calms down, the commissions will decrease. However, you need to be prepared for the fact that even greater attention to cryptocurrencies will create a much greater increase in the cost of a transaction than is observed now.