Only $20 million USDC can be used on the system but with up to 20 percent interest rate earnings, according to the newly established USDC risk parameters. Users will be able to deposit USDC as collateral (in addition to the system’s two other underlying assets, ether (ETH) and Basic Attention Token (BAT)) and receive dai in return.

MakerDAO has added a third asset to its decentralized finance (DeFi) platform, USD Coin (USDC), in response to the system’s flagship stablecoin, dai, continuing to float above its dollar peg.

Passed Tuesday at 2:58 UTC, the Coinbase- and Circle-backed USDC is now available for use as collateral on the premiere DeFi platform following an executive governance vote, according to a blog post.

Almost $1 million in USDC-backed dai has been minted since the vote’s passage, according to data site Dai Stats.

At the heart of the USDC addition is a pressing issue: dai’s dwindling supply. Without a larger supply of dai on the market, the stablecoin went for a premium last week which threatened to capsize the largest DeFi platform.

When ETH lost 30 percent of its value in 24 hours on March 12, the whole network flipped into chaos, including dai’s price. Another ETH price crash could prove fatal, community members warned. Some 1.8 million ETH (or roughly $211 million as of press time) is currently locked in.

“I don’t think we ever have this governance conversation unless it was an absolute emergency”, said Chris Padovano, former legal advisor to the MakerDAO Foundation in a governance call Monday.

“We don’t know what’s going to happen in the next few days. If there was ever a time to be brave and do this, now is the time”, he said of adding USDC.

Philosophical implications

Dai’s peg has continued to sit uncomfortably high above the U.S. dollar after “Black Thursday.” Users flocked to dai for stability in the wake of ETH’s crash, increasing the token’s price and lowering supply on the market.

Dai’s supply over the last three months.

The Maker Foundation has made several efforts to find liquidity for dai since March 12. A governance vote by MKR token holders tinkered with various network metrics to increase the supply of dai and therefore alleviate illiquidity. Monday’s vote also lowered dai’s interest rate (also known as the “Stability Fee”) from 4 percent to 0 percent.

It didn’t work, so the team called in the cavalry: centralized stablecoin USDC.

The pros and cons of adding the collateral asset were weighed Monday on both a governance call and on the Maker Foundation forum. A chief concern was USDC’s issuer and final authority: Coinbase and Circle. Those in favor of alternatives, such as linking Maker with other DeFi liquidity pools, noted Circle’s right to censor addresses at its discretion.

The addition was unprecedented given the DeFi network’s intent to create a “completely decentralized” stablecoin, dai, backed by other cryptocurrencies, according to the white paper.

As events have panned out, dai’s hold above $1.00 – and the potential consequences from it – have remained a larger concern for the Foundation and MKR holders who executed the vote.

Do or dai

Dai is a barometer for Maker. If the stablecoin sits above the dollar peg, it means the underlying token economics are not working as intended.

In this situation, particularly after ETH’s price drop, Maker community members held two concerns: the system is vulnerable to a second flash drop in ETH’s value and dai is extremely illiquid on the general market right now, according to Maker Foundation community manager LongForWisdom in Monday’s call.

First, ETH’s last flash drop created a $5.7 million debt within the Maker system. This debt was created by a flaw in the auction of the collateralized debt that users put in smart contracts to create dai. These smart contracts are called collateralized debt positions (CDP).

In short, the price of ETH dropped below the collateral levels for some CDPs, triggering instant liquidations. Liquidations are sold on an open market between automated market makers called “keepers.” This open market, as it turned out, was not so open.

Due to a bug in the system, certain keepers were able to purchase auctioned collateral (typically ETH) for practically no cost during the chaos of Thursday and early Friday’s trading action. The network announced the printing and sale of MKR tokens to cover the debt. This token auction is provisioned in the white paper.

What is not provided for – and as unhappy investors CoinDesk spoke with expressed – was the total loss of ETH from CDPs. A 13 percent “slashing fee” to cover the liquidation of ETH is what most investors expected.

Pete Johnson, a Maker CDP holder who claims to have lost some 2,700 ETH (currently valued at roughly $315,000), is now forming a legal effort against the Maker Foundation with some of the other 4,000 CDP vaults that lost large portions of ETH to the protocol. (Note: One vault does not equal one owner.)

Will it succeed? To a large degree, it doesn’t matter. What does matter is that the largest DeFi protocol choked during a stress test.

Another drop in ETH’s price could not only create another debt burden on the system, but could create an untenable leakage of DeFi enthusiasts.

“Due to the on-going liquidity situation and dai price instability, we need to make a quick decision on risk parameters such that the executive can go on-chain as quickly as possible”, MakerDAO community member Cyrus said in the proposal forum Monday.

Indeed, the Maker team rushed to find a patch.

Not only was a 24-hour governance timeout rule to safeguard the system from internal enemies dropped to four on Saturday, but Maker added USDC when the same conversation six months earlier, concerning tether (USDT), called for a “comprehensive evaluation process” that would “lay out all the risks and problems associated with the collateral.”

If Maker goes, where goes DeFi?

Probably not a question most Ethereum fans want to ask right now, though some are preparing. A list of over 100 DeFi enthusiasts have vowed to act as the “buyer of last resort” for the upcoming MKR token sale.

USDC and dai’s search for liquidity

Still, the underlying issue in Maker remains dai, Messari researcher Jack Purdy told CoinDesk. For now, the Maker community is pinning its hopes on the more centralized USDC.

To be fair, there is precedent. You can buy dai on plenty of exchanges with USDC.

And again, backing a decentralized stablecoin with a centralized stablecoin is not a new idea for Maker. The concept was floated around last September with USDT.

At the time, MakerDAO founder and CEO Rune Christensen said adding a stablecoin like USDT to the Maker ecosystem added liquidity for market makers, which, in turn, would bring price stability to dai.

In asset trading, market makers present buying and selling options across a wide range of prices. They make small arbitrage gains across large volumes while providing the market with much-needed liquidity. In other words, market makers help pricing.

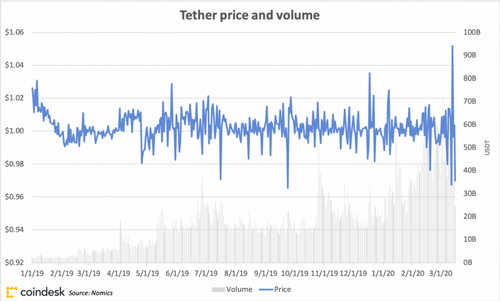

Stability, of course, should be a feature of a stablecoin. Historically, dai and other less liquid stablecoins have lacked price stability compared to the most liquid stablecoin on the market, USDT.

Tether’s trade volume reaches into the many billions, but the price remains relatively stable.

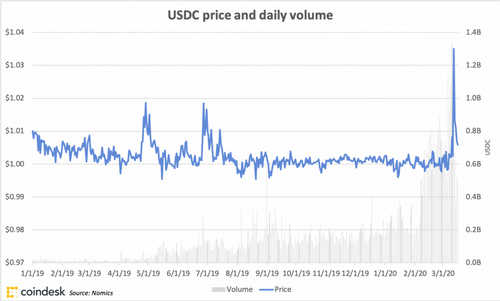

USDC lost its peg by a few cents after surpassing $1 billion in trading volume in early March.

Dai’s peg was broken after only a few million in trade volume. Proponents are looking to USDC to reassert the peg.

“The result is that Dai will become significantly more liquid against any stablecoin that is onboarded as Dai collateral”, Christensen wrote at the time. “At scale, you can almost think of it as if Dai starts behaving like a fiat-backed stablecoin itself, in that it will be so easy to exchange it 1:1 with very low spreads to USD and fiat.”

All choices have trade-offs, however.

To add a stablecoin such as USDT would decrease Maker’s censorship resistance. A company, Tether Inc., is behind USDT, unlike dai, community members said. Companies can be censored or shut down; decentralized protocols can’t. Ultimately the team decided to refrain from adding USDT until the need for another asset became more apparent.

That day came six months later as the price of ETH tanked and dai’s price skyrocketed, hitting $1.22 on CoinGecko while accruing upwards of 20 percent interest on DeFi platform Compound.

The price jump left CDP holders paying extra to close positions along with difficulty in locating dai on the market. One week later, dai continues to sit seven cents above its peg while the Maker community jengas its token back to normalcy.

From a technical standpoint it’s likely the addition of USDC will work. Dai faced a similar issue in spring 2019 where dai sat about as far on the other side of the dollar as it currently does.

In response, the community voted to up the Stability Fee (interest given to dai holders) from 0.5 percent to 19.5 percent over multiple months. The 39-fold increase flummoxed some, but gradually restored the dollar peg by increasing demand to hold dai.

The rushed decision and addition of a decidedly non-decentralized asset to Maker’s ecosystem is another question entirely. Indeed, market participants in Asia woke up to the passed governance vote without being asked about its consequences.

Moreover, liquidity and undercapitalization are not the same thing, Messari’s Purdy said.

“It makes sense to get more dai liquidity, although it doesn’t help the underlying undercapitalization issue”, he said about the USDC addition.