The Nasdaq-listed rig builder revealed its concerns in its annual 10-K report with the Securities and Exchange Commission, filed Wednesday. Such reports always include a “general risks” section detailing worst-case business scenarios. This year, Riot added two pandemic-specific subsections to discuss COVID-19.

Riot Blockchain is worried that COVID-19 may “seriously disrupt” its bitcoin mining operations.

Riot Blockchain is getting thrashed by the response to COVID-19, the general risk section shows. Its workers being quarantined and going into self-isolation while its supply chain is seizing up under border restrictions and factory closures, according to the filing.

It also has the unwanted label of being a “nonessential business.” According to the 10-K, Riot has not been classified as an essential business in any of “the jurisdictions that have decided that issue to date.” That potentially cuts off access to Riot’s offices and mining rigs.

“If we are unable to effectively service our miners, our ability to mine bitcoin will be adversely affected as miners go offline”, Riot wrote.

Riot’s concerns echo issues Chinese mining farms faced nearly two months ago. In early February, PandaMiner chief operating officer Abe Yang told CoinDesk that his company had difficulty operating some of its farms due to quarantine controls in certain provinces because they had limited staff repairing machines and running the hardware.

At present, Riot’s Oklahoma City, OK operation features 4,000 Bitmain S17 Pro Antminers purchased over December 2019 for $6.35 million total, according to two press releases issued at the time. Those rigs replaced Riot’s older fleet of about 8,000 S9 models, now offline, the 10-K shows.

The “catastrophic” business ramifications of COVID-19 are hardly unique to Riot Blockchain; nearly every business is facing an existential threat that only four months ago would have sounded absurd.

It’s an open question where all this will lead. Riot admits that the pandemic’s “sweeping nature” makes it next to impossible to predict the long term impact. One thing is certain, though:

“If not resolved quickly, the impact of the novel coronavirus (COVID-19) global pandemic could have a material adverse effect on our business.”

Riot’s Stock Dips 5% as It Focuses on Bitcoin Mining Ahead of Halving

Riot Blockchain, a Nasdaq-listed crypto firm in the United States, plans to sell its exchange to focus on Bitcoin mining ahead of the halving.

According to an official announcement on Feb. 20, Riot has “opted to sunset further development of Riot’s U.S.-based digital currency exchange” in order to focus on cryptocurrency mining as part of its updated strategic priorities for 2020.

Following the announcement to shift its focus on Bitcoin mining, the company’s shares dropped more than 5%, trading at $1.40 at press time, according to CNBC data.

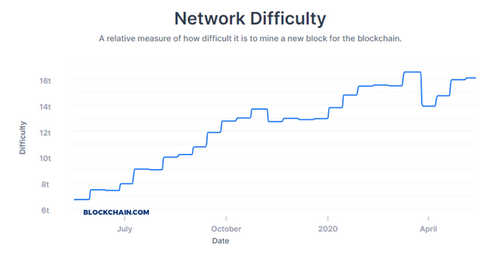

Industry experts disagree on the potential price impact of May 2020 Bitcoin halving – an event which will decrease block rewards on the Bitcoin blockchain. Changpeng Zhao, the CEO of major crypto exchange Binance, recently predicted that, since miners will have to spend twice as much to mine a single coin, the price of Bitcoin could increase significantly.

Riot cites the U.S. regulatory landscape as a factor for closing

Known as RiotX exchange, Riot’s crypto exchange business was purportedly launched in the second quarter 2019, following the company’s filing with the United States Securities and Exchanges Commission (SEC).

Riot said that its decision to close the newly launched exchange was caused by a number of factors, including the “evolving regulatory environment.” Riot wrote:

“Riot considered a number of factors when evaluating the RiotX decision including, but not limited to, the evolving regulatory environment, cybersecurity risks, and the current competitive landscape facing U.S. based cryptocurrency exchanges. Riot is considering opportunities to divest the limited assets associated with the RiotX in the best interest of the Company and its stockholders.”

Riot Blockchain has been concentrated on crypto mining operations and investing in blockchain technologies since 2017. Providing mining facilities for major cryptos like Bitcoin, Bitcoin Cash (BCH) and Litecoin (LTC), Riot has now reinforced its confidence in Bitcoin by focusing on BTC mining and pursuing opportunities more directly related to BTC mining, the announcement states.

As reported by Cointelegraph, Riot Blockchain is a former biotech firm that opted to change its name to include the word “blockchain” in 2017, subsequently seeing its shares skyrocket from $8 to over $40. The spike in share price subsequently brought Riot under the SEC’s spotlight in 2018.