The litecoin blockchain reached the trigger block height of 1,680,000 at 10:16 UTC on Monday, according to the litecoin explorer from mining pool operator BTC.com.

Litecoin (LTC), currently the fourth-largest cryptocurrency by market capitalization, has just reduced its block reward for miners by half.

The event marks a major threshold for miners, as the litecoin network is designed to reduce its mining rewards by half every 840,000 blocks (roughly every four years).

For this “halving”, the mining reward for every block has been reduced from the previous 25 LTC to 12.5 LTC.

Given the block production time on the litecoin network is around one block every 2.5 minutes, roughly 576 blocks are produced in every 24 hours with a new supply of 7,200 LTC entering into the market – half the previous daily level of around 14,400 LTC.

As of press time, about 63 million out of the total issuance of 84 million LTC are effectively in circulation, leaving about 21 million LTC block mining rewards – worth $2 billion at today’s prices – available for miners to compete for in the future.

Since early this year, LTC’s price has seen a significant uptick from around $30 in January to as much as $120 in June, but has since then decreased to around $100.

In line with the price increase ahead of the anticipated halving event, hash rate computing on the litecoin network and the mining difficulty have both jumped by 200 percent since end of December 2019.

The halving will likely have an affect on the interest in mining participation, as several widely used litecoin mining devices will now have a tough time generating enough LTC to offset electricity costs.

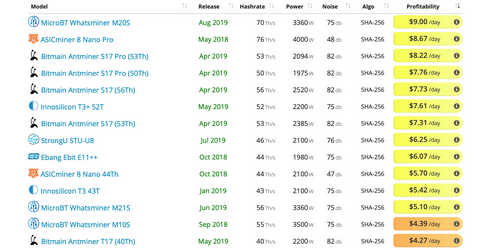

According to a miner profit index from f2pool, one of the world’s largest mining pools by hash rate, the three most profitable LTC miners made by InnoSilicon and FusionSilicon X6 had a profit margin of between 55 and 60 percent before Aug. 5.

Other older models such as Bitmain’s AntMiner L3, however, already had a profitability that was less than 50 percent based on an electricity cost of $0.04 per kWh and LTC’s price before the halving.

Holding everything else constant, reducing the mining revenue by half could lead to a net loss for miners with such older models, as Shixing Mao, co-founder of f2pool, said in a Weibo post:

“With an electricity cost of 0.26 yuan $0.037 per kWh, miners like L3+ can pretty much just shut down tonight.”

Litecoin ‘Largest Miner Capitulation’ Great News for Bitcoin

The difficulty is a measure of how much computing effort is required to process transactions on a cryptocurrency’s blockchain. A drop in price can make miners retire due to low profitability, which triggers a drop in difficulty. This, in turn, has implications for network security.

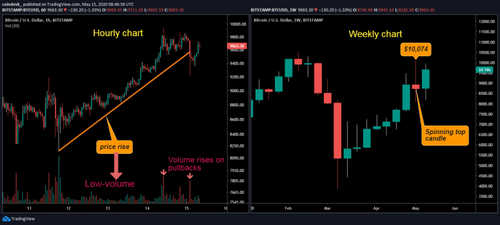

Bitcoin could have its bull market induced by Litecoin (LTC) as the latter enters a bullish renaissance, noted statistician Willy Woo has forecast.

In a series of tweets on Jan. 6, Woo, well known in crypto circles as the creator of data resource Woobull, highlighted an upturn in Litecoin’s fortunes in recent weeks.

Woo: Litecoin difficulty “in recovery”

Specifically, it is the altcoin’s mining difficulty that has begun rising once more after more than six months of decline.

Woo said the second half of 2019 was “the largest miner capitulation LTC has ever faced.” Data from Woobull confirms difficulty dropping from over 16 million last July to just 4.7 million in mid-December.

Since then, the difficulty has begun improving, currently standing at 5.1 million. This, Woo says, could not only produce a bull run for Litecoin but spill over to fuel the already bubbling Bitcoin market.

“Litecoin Difficulty Ribbon now in recovery”, he wrote in further comments, adding:

“Should set up a bullish breakout of the bearish channel. I wouldn’t be surprised if LTC leads a bullish breakout of BTC.”

LTC major gains yet to appear

Litecoin launched in 2011 as a hard fork of the Bitcoin Core client and is currently the sixth-largest cryptocurrency by market cap.

Despite losing considerably in the altcoin collapse of 2018, the coin’s performance improved in 2019. As Cointelegraph reported, LTC/USD jumped from $32 to $141 in the first half of the year – frontrunning Bitcoin’s own leg-up that began on Apr. 1.

In November, Cointelegraph contributor Keith Wareing forecast “significant” incoming gains for LTC holders. In the event, markets hit $61 before declining to $37 before Christmas. At press time, Litecoin traded at $45 on 1.3% daily gains, modest compared to Bitcoin’s 5.5%.