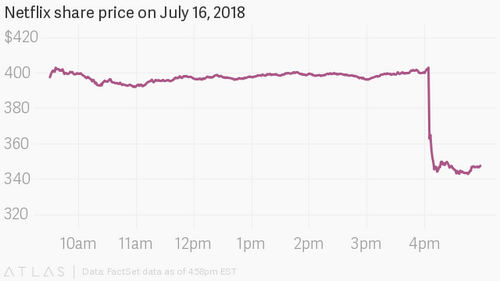

Netflix shares are down more than 14% in after-hours trading, at $343.92 at the time of this writing, after the company said it added far fewer subscribers than it forecasted during the second quarter of 2018.

As of the close of trading today (July 16), shares of Netflix had more than doubled in value this year, pushing the company’s market value beyond media giants like Disney and Comcast. Then, the streaming-service’s stock had a reality check.

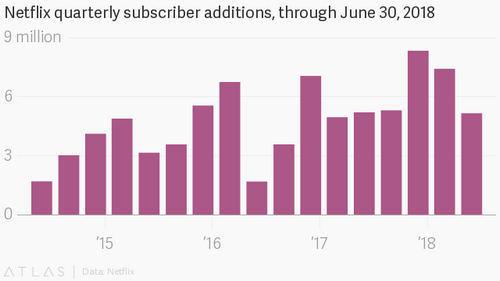

Netflix’s stock lives and dies on subscriber growth and it has now missed on its forecast three times in the last 10 quarters. The company added 5.15 million new members in the quarter ending June 30, it announced (pdf) today, after saying in April that it expected to add 6.2 million subscribers during that period. It missed its own estimates for both domestic and international subscriber growth. Netflix now boasts 130 million subscribers worldwide.

Content wise, it was a thoroughly dull quarter. New seasons of high-profile shows like 13 Reasons Why, Luke Cage, GLOW, and Unbreakable Kimmy Schmidt failed to capture the buzz of previous seasons. A slew of new romantic comedies hit the service, but there were no major movie debuts. Overall, there wasn’t a whole lot to get excited about-or sign up for, apparently. (Netflix did, however, manage to unseat awards darling HBO for Emmy nominations-announced last week-which it touted in its quarterly note to investors.)

The streaming service’s bill for TV shows, movies, and specials has ballooned over the past few years as it invests more in making and marketing originals. It expects to spend a staggering $10 billion on programming and marketing this year, and The Economist projects that could go even higher. Investors think the content investment will eventually pay off if Netflix can keep building its subscriber base. But weaker than usual subscriber growth casts doubt over whether Netflix can continue spending its way to the top.

Today’s miss also raises questions over whether the company will be able to withstand stronger competition. Rivals Amazon and Hulu are investing more in originals, and reworking their content strategies. HBO, now owned by AT&T, is reportedly readying to take more direct aim at Netflix (paywall). And Disney will be joining the streaming fray soon, which could inspire other studios to launch their own services.

UBS downgraded Netflix to a neutral rating last week, arguing that the stock has already absorbed much of the upside.

Netflix gave modest guidance of 5 million subscriber additions for the third quarter.