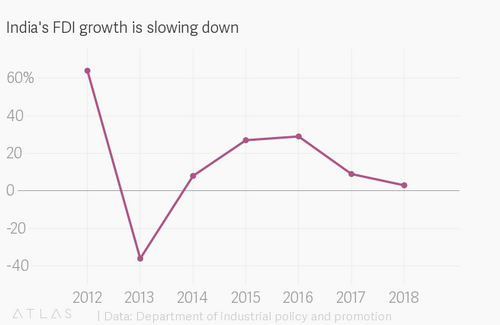

In the last financial year, India’s foreign direct investment (FDI) growth plummeted to a five-year low of 3%, hitting $44.85 billion, according to data released by the department of industrial policy and promotion.

All the pomp and celebration around Make in India. Prime minister Narendra Modi’s endless foreign trips selling the country’s growth story. His government’s relentless pitching of the Asia’s third-largest economy being in its best shape ever. But the numbers tell a very different story.

The service sector, which includes banking and financial services, insurance, non-financial businesses, research and development, and analysis, attracted the highest FDI in 2017-18, followed by the computer software and hardware sector, telecommunication, and automobile sectors.

This is a stark change from the time Modi came to power in May 2014.

Foreign investments skyrocketed to 27% and 29% in financial years 2015 and 2016, respectively. However, now the magic seems to be waning slowly but surely.

“This does not augur well for India because this not only affects India’s capital position but also means that the external source for funding domestic projects is drying up”, said Indranil Pan, group economist at IDBI Bank.

In order to lure more global investors, the government even relaxed the FDI norms significantly, but foreign investors are not buying it.

Instead, they seem to be betting on other developing economies. For the first time since 2015, India was out of the list of the top 10 economies on global investors’ radar, showed a report by AT Kearney published in May this year.

As if declining FDI wasn’t enough, foreign institutional investors, too, are pulling out for the first time in a decade. They have sold equity worth nearly Rs6,000 crore and debt of over Rs41,000 crore so far in 2018, according to Bloomberg data.

The situation is only likely worsen this year. “It is the election year and investors are going to hold onto their funds and are unlikely to invest in times of uncertainty”, added Pan.