Retail merchants in the country, particularly, suffer high fraud rates, losing about 5% of their total gross merchandise value annually, the report released on Nov. 22 by Experian, a global information services company, says.

It’s fairly easy to cheat Indian consumers-about 48% of them have directly or indirectly experienced fraud, a new study shows.

The report was based on a survey of three sectors-banking, retail, and telecom. Prepared in collaboration with market research firm International Data Corporation, it included 3,200 respondents from 10 countries across Asia-Pacific (APAC).

It also reveals that India is among the top-four countries in terms of digital adoption, digital banking account sign-up, and utilisation.

Experian itself had launched Hunter, a fraud detection service, in 2011, which, it says, helped the finance industry save about Rs10,200 crore ($1.57 billion) in fiscal 2017 alone.

Vaishali Kasture, who heads Experian India, spoke to Quartz on fraud-related issues. Edited excerpts:

What are the key takeaways of the report?

Firstly, in India, the average consumer trusts banks more than the government. Second, India has the highest number of shopping apps per person in the APAC region: three. Third, although India has one of the highest digital adoption rates across APAC, it also witnesses a very high rate of frauds-almost one in every two persons has directly or indirectly been subjected to some fraud.

What’s interesting here is that Indians still trust banks and e-commerce firms that swing into action and manage the outcome of the fraud. This happens because the institution does not want to lose a client in the long run.

What are the insights on consumer loans?

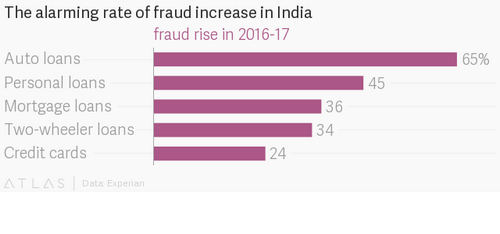

An extremely interesting trend emerged in the financial services segment. Secured loans, that is the auto, two-wheeler, and mortgage segments, saw a higher rate of increase in frauds.

These are also larger-ticket items as compared to unsecured loans such as credit cards where the rate of fraud grew at a slower pace. In absolute terms, the numbers may not amount to a lot but the pace at which frauds are rising is fairly significant.

Are you considering any new parameters for individual credit-risk assessment?

We are also looking at building a dynamic credit score instead of a static one. For instance, factors such as income estimation and residential stability (traditionally excluded) are being taken into account. Even things like social media, geographical positioning, and SMS data can give an informal idea about an individual’s credit profile. We are working on some pilots that include these alternative data. These can be beneficial in judging first-time borrowers or people who are not a part of credit bureaus.

What are the new products and services that you are launching?

We will launch a digital identity protection solution that will help detect compromised personal information in real time, no matter where it occurs. It’s hard to remember the credentials for all our online accounts, and it’s common practice to use the same username and password combinations across multiple sites. If one account is cracked, it may be possible for fraudsters to access accounts on other sites as well. Our proprietary technology proactively detects stolen personally identifiable information and compromised confidential data online.

Do you think Indian companies are well-equipped to handle fraud?

Big companies and firms are laying great emphasis on cyber-security and investing adequately to protect data. But when it trickles down to smaller firms, my personal take is that there is still more work to be done.