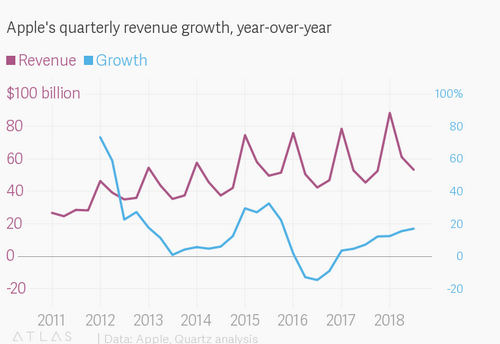

There might be fear of a tech-led market bust right now, but Apple didn’t seem to get the memo. The Cupertino, California, electronics giant posted a record $53.3 billion in revenue for its fiscal third quarter, a jump of about 17% from a year earlier, it announced today, July 31.

Analysts had expected Apple to generate $52.3 billion in revenue for the quarter, roughly the midpoint of the guidance Apple gave on May 1.

What’s traditionally seen as Apple’s slowest quarter is really anything but. For the quarter, it generated $11.5 billion in profit, a jump of 32% over the same quarter last year.

The company’s stock price was up about 3.5% in after-hours trading, to $196.20, at the time of publishing. It’s getting very close to becoming the first trillion-dollar public company in history.

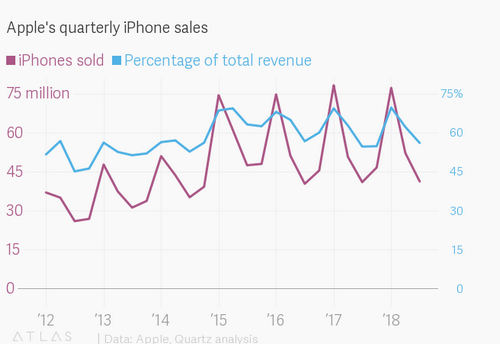

Questions had loomed prior to today’s release over whether demand for the iPhone X, Apple’s $1,000 flagship phone released in September, had started to wane.

Reports had suggested that, although the iPhone X was the most popular phone every week of the second quarter, consumers were opting for the larger, slightly more affordable, iPhone 8 Plus.

These reports proved to be largely unfounded, as the average price of an iPhone only dropped slightly over last quarter, from roughly $728 to about $724. CEO Tim Cook said on a call with analysts that the iPhone X was the most popular phone of the quarter again.

The company sold 41.3 million iPhones in the quarter, and chief financial officer Luca Maestri attributed the strong average selling price to the X, along with iPhone 8 and 8 Plus sales.

Apple investors were likely buoyed not only by the strong earnings beat-its best third quarter ever-but also the company’s guidance for the current quarter. Apple estimated it’ll generate between $60 billion and $62 billion in revenue, which would be an increase of roughly 15% over last year at the low end.

Apple’s overall business may still be quite cyclical, but Apple’s services business-sales of apps, music, games, AppleCare, and Apple Pay fees-has been growing near-continually for years. Apple Music and cloud services both grew 50% quarter-over-quarter, Cook said on the call.

Its service business has been a massive success story in recent quarters, reaching the size of a Fortune 100 company on its own. It posted revenue of $9.5 billion during the quarter, a jump of roughly 31% over the same period last year.

Apple’s replacement for the PC has been outpaced in sales by regular old computers in recent quarters, and this one was no different. Mac sales still bested iPad sales, although the gap is closing-perhaps all those ads convincing consumers that the iPad Pro can be used as the only computer you need are finally taking off.

Maestri did concede, however, that it released its newest Macs at slightly different times this year than in the past, which might have slightly affected sales for the quarter.

Since Cook took over as CEO, Apple has only released one entirely new product line, the Apple Watch. Although the product itself has greatly improved since its 2015 launch, it’s difficult to tell exactly what impact it’s had on Apple’s business. The company lumps Watch sales into its “Other Products” bucket on earnings statements, which also includes its AirPods wireless headphones, Beats audio products, and other accessories. The Other Products segment grew 36.5% over the same period last year, but growth in the category has slowed over sequential quarters.

AirPods also appear to have been a hit since they were first released in late 2016, but in both cases, Apple has not opted to enumerate how many devices it’s sold.

Cook said Apple Watch sales grew in the “mid-40% range”, and Maestri said Apple has been selling AirPods as quickly as the company can make them.

Apple has struggled to gain footing in markets it’s previously identified as growth opportunities, including China and India. It’s lost ground to more affordable but still high-quality phone makers in India, where Apple recently lost three key executives, and it has struggled with regulators (paywall) in China.

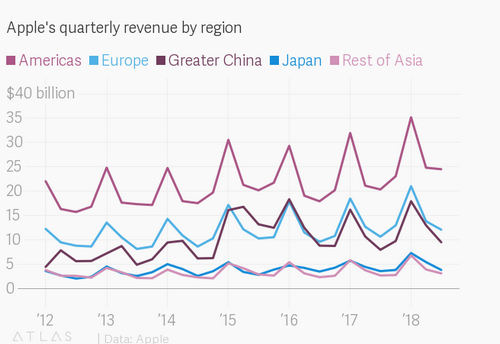

But there were positive signs this quarter: Revenue in China was up nearly 20%, and 15% in the rest of Asia (which includes India) over the same period last year. But Apple still relies heavily on sales in the Americas-which accounted for 46% of its total revenue-and China has not able to regain its spot as Apple’s second-largest market, which it relinquished back to Europe in mid-2016.