That doesn’t go down so well with Muslim nations. In the Islamic faith, it’s believed that economic activity should be based on real, physical assets, not speculation; observant Muslims also do not invest in banking products that offer returns via interest payments. Therefore, many people in the Gulf states and beyond don’t consider bitcoin, ethereum, and other cryptos to be compliant with Sharia law.

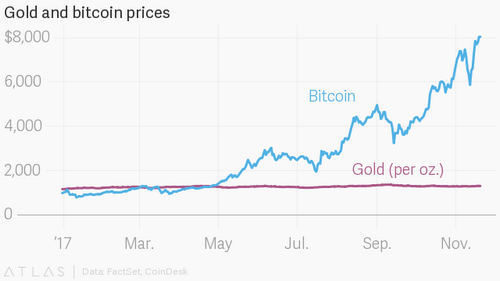

Cryptocurrency is not great for your blood pressure. With prices soaring and plummeting on a weekly basis, there is a fast buck to be made, but also a lot to lose-and quickly.

Cryptocurrencies writ large have not yet been officially banned in Saudi Arabia and the United Arab Emirates, but these governments have issued warnings about their citizens purchasing bitcoin. Because of this, Muslim markets have been slower to trade in digital currencies. And there is a lot of money to be made in Islamic finance: Muslim countries contribute about 1% of global GDP.

To serve these wealthy Islamic populations, a new type of Sharia-approved crypto is cropping up.

In Dubai, a startup has created a cryptocurrency that is backed to one of the world’s most stable assets: gold. OneGram’s pitch is that each unit of value is backed by a physical gram of gold that is kept in a safe. This therefore limits volatility and speculation, and has been deemed acceptable under Islamic principles by Dubai-based al-Maali Consulting.

“We are trying to prove rules and regulations from sharia are fully compatible with digital blockchain technology”, said cofounder Ibrahim Mohammed, according to Reuters.

Gold stays relatively stable-it has hovered between $1,200 and $1,350 for the past year-while bitcoin’s price fluctuates widely day to day. After climbing to an all-time high of nearly $20,000 in 2017, the price has been falling this year, sitting at time of writing at $7,000.

In traditional markets, the price of gold is often used as the measuring bar for how the global economy is doing. If things are looking unstable, the price of gold goes up. That’s because it’s a safeguard against economic unrest or the inflation of a fiat currency; if the stock market crashes, you’ve still got physical assets sitting in a safe. The concept of gold being a safe bet, rather than a gamble, therefore also aligns itself more closely with Sharia’s anti-risk rules.

The Middle East isn’t the only area playing with gold-backed crypto.

HelloGold, a similar concept with gold being stored in a vault in Thailand, was founded last year in Malaysia. It was recently Sharia-certified and wants to break into the Thai market this year. Southeast Asia is another hotspot of Islamic finance, with Indonesia and Malaysia being Muslim-majority countries. (More than 80% of Indonesia’s 250 million citizens are Muslim, making it the largest Islamic population in the world.)

If Western crypto communities want to play in the Gulf and Southeast Asia, they’d therefore be wise to create products that are Sharia-compliant. “In recent years, the Middle East has seen incredible growth in fintech innovations including digital tokens and smart contracts”, OneGram co-founder Mohammed told Forbes. “With OneGram we are providing an opportunity for investors who care about Islamic financial markets and the security of commodity-backed investments.”

It’s not quite a gold-standard crypto-but it’s close.