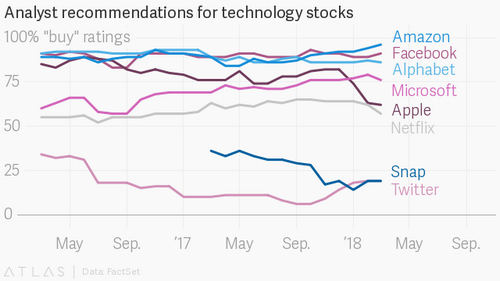

Facebook may have lost well over $90 billion in market value over the past week or so, but analysts are keeping the faith. In fact, some 90% of brokers who cover the stock have a “buy” rating on the company, according to FactSet. Among major tech firms, only Amazon has a higher share of analysts with such a bullish outlook. Other social networking firms, like Twitter and Snap, are far worse bets than Facebook, brokers believe.

Stock analysts are a preternaturally bullish bunch. Missed earnings guidance? “Overweight.” Accounting snafu? “Outperform.” Unauthorized leak of 50 million users’ personal data to a shadowy political consulting firm? “Buy.”

Why the sunny outlook? After all, Facebook is facing a slew of regulatory and legal issues in the wake of the Cambridge Analytica scandal, as well as continuing worries about the company’s role in perpetuating fake news. It’s the subject of a probe by the US Federal Trade Commission. CEO Mark Zuckerberg is planning to testify before the US Congress, while the UK parliament is mad at him for sending deputies in his stead.

Meanwhile, 37 US state attorneys wrote a letter to Zuckerberg pushing him for answers about Facebook’s protections (or lack thereof) on user data. And the lawsuits just keep coming.

But many analysts are confident that Facebook can take the heat. They believe that whatever loss of trust or regulatory crackdown the social networking giant may face today, its long-term prospects remain unchanged. Even if its handling of personal information is suspect, Facebook has amassed so much data about its 2 billion users that there isn’t any credible competition or threat with nearly the same scale.

The 45 analysts tracked by FactSet who publish a recommendation for Facebook have put an average target price of around $220 on its shares. That’s more than 40% above where the stock is trading today, and 14% above Facebook’s all-time high.

Crisis, what crisis?