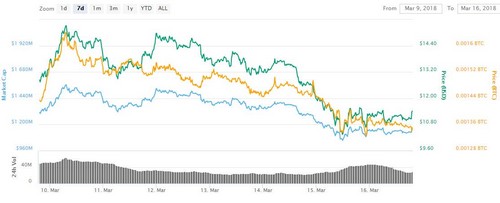

The total market capitalisation for the cryptocurrency industry fell to $309 billion early on Thursday, dropping from just under $400 billion on Monday, according to figures from CoinMarketCap.

Bitcoin saw its price drop to a low of $7,800 during early morning trading today, pushing its market cap value down to $131 billion. At the time of publishing, though, it has recovered slightly and is trading at $8,284.

Market prices across the board have also fallen into the red today, with ethereum and ripple following a similar pattern. Ethereum fell below the $600 mark, a significant drop considering it reached an all-time high of $1,400 at the start of January. Ripple went down from $0.80 to $0.65 in a 24-hour period.

This sell-off in the market is down to several factors. Early this week, Google announced that it will be placing an advertising ban on all cryptocurrencies and related content, including initial coin offerings (ICOs), crypto exchanges, wallets, and trading advice, from June.

However, even though Google’s advertising ban is being felt in the market, Matthew Newton, analyst at eToro, is of the opinion that prices were stagnating before the announcement.

“Cryptocurrencies have taken a series of hard knocks over the last few weeks, from the SEC’s ruling on crypto exchanges to reports of a bear whale with the Mt Gox case”, he added. “The resulting lack of buying opportunities has left even the more seasoned investors with a sense of frustration.”

According to documents published earlier this month, a trustee of the now-defunct Mt Gox bitcoin exchange sold around $400 million worth of the cryptocurrency in order to pay back creditors. This has been hitting the price of bitcoin.

Crypto market prices saw a sharp downward trend during trading Thursday following the news that Google is to ban advertising related to the sector and amid increasing regulatory pressure to monitor the market.

Another factor that is impacting market prices is due to the ever-increasing pressure for the industry to be regulated. Earlier this month, the U.S. Securities and Exchange Commission released a statement that said online platforms that trade in crypto assets that are considered as securities would be required to register with the agency and yesterday, The U.S. House of Representatives Capital Markets, Securities, and Investments Subcommittee held their first Cryptocurrency Hearing

David Siegel, founder and CEO of the Pillar Project, which is building the next-generation smart wallet, expressed the view that there is a ‘dark cloud’ taking shape in the U.S.

“It’s as if innovation must come at a price – the price of not much innovation that is highly regulated”, he said speaking to CoinJournal. “Many of us are preparing for a ‘regulatory winter’ which could easily last for months.”

Japanese regulators have also been taking a firmer approach on several digital currency exchanges following the hack at Tokyo-based exchange Coincheck. After thieves were able to siphon off $530 million worth of NEM, at the end of January, the country’s financial watchdog, the Financial Services Agency (FSA) conducted on-site inspections at all the crypto exchanges. It has since suspended two exchanges for a month, which lacked the correct management procedures, has issued new orders to four others, and another order to Coincheck.

At the upcoming G20 summit later this month in Argentina, France and Germany are expected to issue a joint proposal calling for bitcoin to be regulated. Whereas, Mark Carney, the Bank of England’s Governor, has said that the cryptocurrency industry should be held to the same standard as the finance sector.

Shane Brett, founder and CEO of GECKO Governance, the world’s first RegTech governance solution for financial services compliance, said that the crypto compliance shakeout has started.

“The forthcoming regulatory hammer will be the key trend driving crypto and ICO valuations this year”, he added. “Multiple jurisdictions are simultaneously closing the noose on ‘bad actors’ and inadequate governance in this space. In the future crypto can expect to be regulated like any other asset class.”