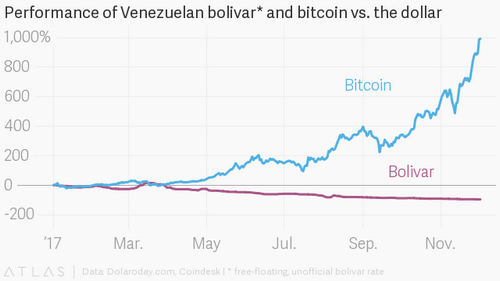

Venezuela’s bolivar has lost nearly all of its value against the US dollar this year, while the price of bitcoin has rocketed by almost 1,000% over the same period.

The unofficial rate that most ordinary Venezuelans use to exchange money has jumped to 103,000 bolivars to the dollar, from about 3,000 at the start of the year. On top of strict domestic controls on foreign-exchange transactions, sanctions imposed by the US have made it difficult for the Venezuelan state to move money in the international financial system, supposedly delaying bond payments and other transactions.

Venezuela might be about to get a second currency, and it could be just as mismanaged as the first. Amid a severe social and economic crisis, Venezuelan president Nicolas Maduro said his government plans to launch the “petro”, a cryptocurrency backed by oil, gas, gold, and diamond reserves.

It’s easy to see why Maduro wants to capture some of the success that cryptocurrencies are currently enjoying, while also opening up an way to circumnavigate international sanctions. But launching a digital currency is unlikely to solve one of Venezuela’s biggest issues: bad governance. Despite sitting on the world’s largest-known oil reserves, economic mismanagement has saddled the South American nation with hyperinflation and poverty.

The announcement of the “petro” came during a Christmas special on state TV that featured five hours of seasonal songs and dancing. It’s unclear whether the digital currency will ever come to fruition. Few details were given. Maduro said the new cryptocurrency would help Venezuela “advance in issues of monetary sovereignty, to make financial transactions and overcome the financial blockade.”

“What is clear is that this proposal seems more intended to distract rather than solve Venezuela’s pressing domestic problems”, said David Coker of the Westminster Business School. “Even if the ‘petro’ does launch, there is no fundamental reason to hold the currency except as a tool of outright speculation.”

The primary allure of cryptocurrencies is that they are decentralized, stateless assets that aren’t controlled by central banks. How Venezuela plans to impose control on a cryptocurrency is hard to foresee, especially given its dismal track record with fiat money. Linking the currency to hard assets is another challenge with no obvious solution: Would holders of petros be able to redeem the currency into oil or gold? If so, according to what formula?

Meanwhile, bitcoin mining has surged in the nation as people try to get around the government’s currency controls. Heavily subsidized electricity has helped Venezuelans generate the funds they need to buy vital supplies online.