In time, Draper believes such services will prove their competitive advantage over the the conventional players – credit cards – and will steal market share from them the same way as MasterCard and Visa took market share away from then-dominant American Express.

Speaking at Virtual Blockchain Week, famed venture capitalist Tim Draper confirmed that he is sticking to his six-figure Bitcoin price prediction.

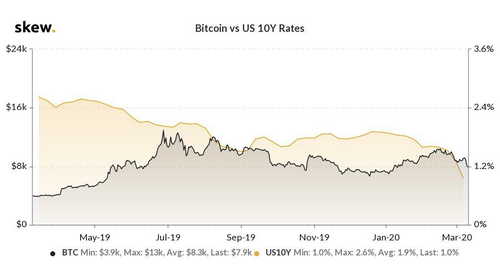

He cites a couple major reasons that might drive that kind of price action. Draper believes that theUS government’s massive stimulus package will debase the value of the dollar and “send people to crypto.”

Back in 2018, Tim Draper made a bold public call that the price of Bitcoin would reach $250,000 by the end of 2022 or early 2023. As of today, he’s sticking to it:

“That’s my prediction. Sticking with it. I’m very confident that that is going to happen. That’s happening. It’s kind of funny.”

He also expects that Bitcoin will see massive commercial adoption around the world within this timeframe.

“All of the sudden, the retailers say, “Oh, you mean I don’t have to pay 2.5-4 percent to the banks every time somebody swipes a credit card?”

Draper says a company called OpenNode (in which he invested $1.25 million) can help make it happen. OpenNode is building a Bitcoin payment gateway on the Lightning Network, known for extremely fast BTC transaction settlements.

Draper also jokingly promised to eat a “raw egg” if his prediction falls short – an allusion to a more savage promise made by John McAfee.

With the halving countdown looming, there’s rising mainstream attention on Bitcoin’s price movements.

Thailand’s First Regulated ICO Portal Targets $98M Token Offering

SE Digital, a subsidiary of major financial services firm Seamico Securities, has been confirmed as the first initial coin offering (ICO) portal operator to be approved by Thailand’s securities regulator.

According to an Oct. 11 report from The Bangkok Post, SE Digital plans to launch Thailand’s first investment token, with a target transaction size of 2-3 billion baht or roughly $65,800,000-$98,700,000.

Moreover, Seamico Securities’ strategic investor, Elevated Returns, has reportedly applied to the Thai Securities and Exchange Commission (SEC) for a Digital Assets Exchange License to launch a new trading venue that would provide a secondary market for such tokens by 2020.

A new chapter in Thailand’s capital market history

SE Digital plans to provide an extensive set of services for ICOs, including strategic advisory, primary issuance as well as support for secondary market access, from compliance to investor communications.

The portal will vet prospective token issuers before they seek approval from the SEC and assist them in meeting requirements such as Know-Your-Customer, CDD, Anti-Money-Laundering and investor suitability. It will also conduct due diligence on the proposed tokens before allowing them to reach investors.

Authorized token investors in Thailand are set to include retail and institutional, high net worth persons, venture capital and private equity funds.

Stephen Ng, Chief Marketing Officer of SE Digital, told the Post that the SEC’s approval was poised to open a new chapter in Thailand’s capital market history and pave the way to its digital economic transformation, as it becomes one of the first ASEAN nations to offer fully-compliant ICOs. He continued to outline that:

“SE Digital will be able to promote the tokenisation of traditional assets providing investors with access to previously illiquid and difficult to access assets such as commercial real estate and investment products with global exposure, while offering issuers with a new fundraising alternative that allows access to a wider pool of capital providers with cost savings accrued from the digitisation on the blockchain.”

An evolving stance

As previously reported, news of the SEC’s plans to authorize an ICO portal in the country first surfaced in November 2018, with further details emerging in March.

In December 2018, the Thai SEC had announced its intention to consider loosening rules that form a barrier to ICOs, although suggested there would be caps on participation.

Unlimited QE and Why Markets Can’t Price In COVID-19

Last October, Ikigai Asset Management’s Travis Kling predicted central banks would have to “juice QE to infinity” in order to save markets from recession. Yesterday on «60 Minutes,» Fed President Neel Kashkari said that“there is an infinite amount of cash at the Federal Reserve. We will do whatever we need to do to make sure there is enough cash in the financial system.”

The market reacts as the U.S. Federal Reserve announced effectively unlimited capital injections including a new array of direct asset purchase tools.

This was followed this morning by an announcement the Fed was giving itself effectively unlimited capacity to intervene in markets. Markets were…still not impressed. In less than two hours, an initial gain had entirely retraced.