In a tweet on March 4, the outspoken crypto critic claimed that Bitcoin should have taken advantage of volatility in traditional markets.

Bitcoin only rallying 3% this week is proof that investors should sell it, according to the latest conclusions from gold bug Peter Schiff.

Despite reclaiming $8,800 since the weekend, Schiff said that BTC/USD “won’t go up” and that therefore selling pressure would ensue.

Schiff on BTC: “Look out below!”

“If @Bitcoin can’t rally with an emergency 50 basis point rate cut, plus all of the recent stock, bond, currency and gold market volatility, under what circumstances will it rally?” he reasoned.

“If Bitcoin won’t go up, why own it? The answer to that question is ‘sell.’ Look out below!”

Proponents used to fending off Schiff’s complaints were quick to point out that overall, Bitcoin had delivered gains several orders of magnitude higher than gold’s since its release in 2009.

“Which one would an intelligent person hold for 8 years? Gold – Still down Bitcoin – Up 2000x”, the @Bitcoin Twitter account retorted.

“Don’t be like Peter”

Commentator WhalePanda took a similar approach.

“Imagine being Peter. Knowing about Bitcoin since 2011. Still trying to say it will crash any day now”, he tweeted.

“Gold is about same price now as it was in 2011. Bitcoin… went from $1 in 2011 to $8.8k now. Don’t be like Peter.”

Despite Bitcoin’s year-to-date returns alone circling 20% at current prices, Schiff has upped the frequency of his claims that its future is doomed. Last week, he described Bitcoin investors and “suckers” and refused to believe in its increasingly-popular status as a safe haven investment.

At the same time, gold suffered its biggest one-day loss since 2013 due to coronavirus fears. After the United States Federal Reserve enacted an emergency 0.5% rate cut on Tuesday, the first such move since the 2008 financial crisis, the precious metal added 2.5%.

Price of Bitcoin Drops After $150 Million Liquidated on BitMEX

Today the cryptocurrency market saw a huge drop in the price of Bitcoin.

According to the data analytics provider Skew on Feb. 26, over $150 million worth of Bitcoin was liquidated on the trading exchange BitMEX, the most seen since the new year began. Millions of dollars of long and short positions caused the value of the cryptocurrency to fall to $8,580, a decrease of more than 6%.

$150mln+ liquidations on BitMEX today – highest in 2020

– skew (@skewdotcom) February 26, 2020

Though the price of Bitcoin slightly rebounded to $8,813, this may be a difficult recovery for the cryptocurrency. The market value dropped nearly $300 in an hour on Feb. 16, bringing BTC well under $10,000.

Traders are already preparing for the possibility the cryptocurrency value may fall below $8,000. This could affect the impression of Bitcoin before the next halving event, scheduled for the week of May 18th.

However, some observers are more optimistic. Tom Lee, a co-founder of Fundstrat Global Advisors, predicted the Bitcoin price would rise to over $27,000 by this summer based on its 200-day moving average.

Global economy’s impact on cryptocurrency markets

Many crypto exchanges and blockchain technology companies have felt the impact of the potential global epidemic of COVID-19, also known as the coronavirus. Employees at Chinese companies responsible for mining have been forced to stay at home or trapped outside of cities as quarantines are enforced.

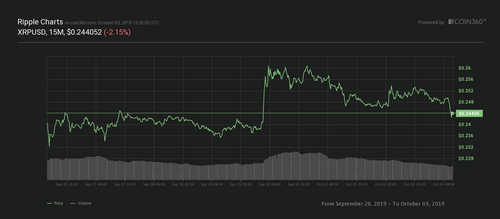

Whatever the reason for Bitcoin’s recent drop, this incident serves as a reminder that the cryptocurrency market can be every bit as fragile as traditional investments. The price of XRP crashed by nearly 60% on BitMEX on Feb. 15.