Litecoin broke below a short-term uptrend to resume its longer-term slide. Litecoin is back on its downtrend as it was rejected on a test of the resistance and has fallen to the mid-channel area of interest. This lines up with the 50% Fib extension just below the $50 major psychological mark.

Stronger selling pressure could take litecoin down to the very bottom of the channel at the 61.8% extension or $45. From there, a continued drop could lead to a test of the 78.6% extension at $38 or the full extension closer to the $30 major psychological mark.

The 100 SMA crossed above the longer-term 200 SMA to suggest a return in bullish momentum but it seems that the moving averages are just oscillating. Another bearish crossover could bring more sellers in and allow the selloff to gain traction.

RSI is hovering close to oversold territory and may be ready to turn higher, reflecting a return in bullish pressure. Stochastic has some room before indicating oversold conditions so bears might have a bit more energy to push price down before a larger bounce is seen.

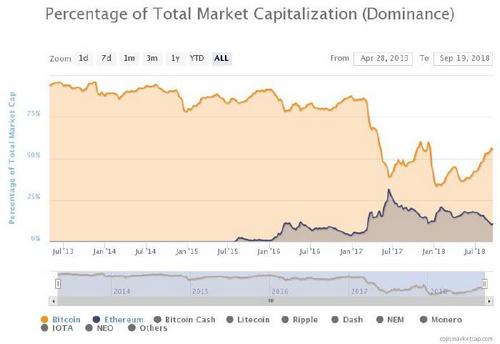

Cryptocurrencies are on shaky ground these days, and it doesn’t help that the ongoing selloff is allowing bitcoin to exert its market dominance. This makes it even more difficult for smaller altcoins to rebound, especially as traders wait for positive catalysts.

Many are keeping their fingers crossed that the SEC ruling on bitcoin ETF applications could serve as the big catalyst for a rebound across the industry this year, but recent events suggest that the regulator might still issue a denial.

Keep in mind that the SEC announced a suspension on trading a couple of crypto-based securities, citing confusion among clients on the underlying market. This suggests that the regulator might take the same reasoning for making a decision on the ETF proposals, even as they already reviewed an earlier rejection.