On Sept. 30, the community manager of the Ethereum Foundation, Hudson Jameson took to Twitter to explain that there are miners mining on the old Ropsten testnet, while others are already mining on the new one.

Ethereum’s system-wide activation of the Istanbul hard fork has arrived two days early and caused a split of the Ropsten testnet.

However, blockchains are complex systems and their updates are difficult to predict precisely. Istanbul arrived two days earlier than expected, which was due to unusually fast block confirmation times, according to Jameson.

Huge miner pushing the non-forked chain

Cointelegraph previously reported that Jameson said that the testnet launch of the hard fork was scheduled to take place at the beginning of October. He added:

“For anyone listening in who doesn’t know how this works, we pick a block number that we estimate to be around the 2nd of October. … However, that might be one or two days behind or forward from that date based on how fast blocks are produced between now and then.”

Most of the miners on the Ropsten testnet network were unaware that Istanbul had arrived, which resulted in a split of the testnet between those mining on the newly upgraded chain and those continuing to mine on the old chain.

Team lead at the Ethereum Foundation Péter Szilágyi stated on Twitter that “the Ropsten Ethereum testnet Istanbul forking is a bit unstable due to a huge miner pushing the non-forked chain.”

Jameson further pointed out that this is what testnets are for and that the Ropsten testnet will be unstable until “this all plays out.” It is unclear if this “hiccup” will have any effect on the Istanbul hard fork activation.

Ethereum blockchain almost full?

Cointelegraph previously reported that Ethereum co-founder Vitalik Buterin stated that the Ethereum blockchain is almost full, which seems to keep potential Ethereum contributors from joining. He added:

“Scalability is a big bottleneck because the Ethereum blockchain is almost full. If you’re a bigger organization, the calculus is that if we join, it will not only be more full but we will be competing with everyone for transaction space. It’s already expensive and it will be even five times more expensive because of us.”

Dydx Processed $1.1 Billion Cryptocurrency Loans in 12 Months

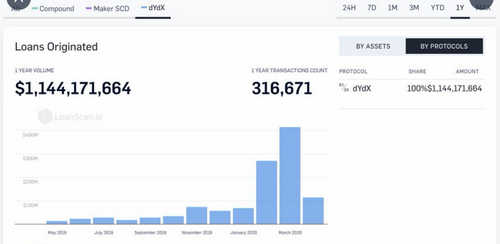

Monthly volume remained below $100 million in the nine months to January but rose sharply between February and March to about $300 million and $400 million, respectively, the latest data from the company shows. More than $100 million worth of loans have been lent out so far this month, indicating a steep decline in investor appetite to borrow.

Cryptocurrency lender Dydx advanced a total of $1.14 billion in digital asset loans over the past 12 months. But about 70% of the money was borrowed in just two months, February and March, as coronavirus-linked volatility triggered a frenzy of borrowing among investors.

Cryptocurrency prices fell sharply during this period as coronavirus lockdowns sent markets crashing throughout the world. Ethereum, a dominant currency of exchange on Dydx, dropped below $100 at the time but has since recovered to above $180.

Dydx loan originations over the past 12 months.

About 45% of the total loan portfolio, or $516.64 million, is denominated in ether while 33%, or $378.67 million, comprises dai loans. USDC loans account for the remainder of the equivalent of $128.08 million.

The decentralized margin trading exchange did not detail the type of borrowers it lent to or how they utilized their funds. However, with such market volatility, investors typically try to hedge derivative investments or bet on the direction of certain cryptocurrencies.

Antonio Juliano, the founder of Dydx, said traders scrambled to use his margin trading facility as coronavirus volatility reached a fever pitch, according to media reports. But that has since started to decline because volatility had slowed down, he said.

Dydx is a decentralized exchange for margin trading. It operates on the Ethereum Blockchain, allowing users to trade, borrow or lend three digital assets – ether, dai and USDC – with leverage of up to 4x. Cryptocurrency loans are emerging as an increasingly viable alternative to borrowing fiat.