Jeremy Grantham, co-founder of the GMO investment management firm, wrote in a letter to investors that he believes that Bitcoin, along with the stock market at large, is in a bubble. Famous for predicting the market crashes of 2000 and 2007, Grantham holds that “a melt-up or end-phase of the bubble within the next 6 months to 2 years is likely.”

To Grantham, A Bubble Unlike Any Other

In his usual report on market trends, Grantham dedicated a section to address Bitcoin’s meteoric rise.

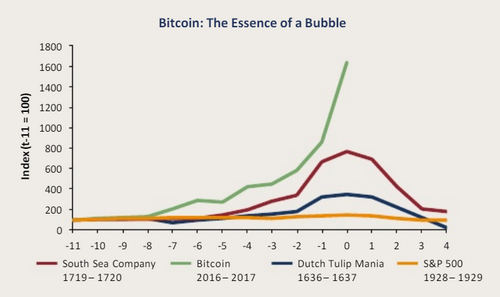

“Having no clear fundamental value and largely unregulated markets, coupled with a storyline conducive to delusions of grandeur”, Grantham writes, “makes Bitcoin more than anything we can find in the history books the very essence of a bubble.”

He goes on to add that “anyone around in 1999 and early 2000 has had a classic primer in these signs”, arguing that historical precedent would have the bubble “crash and burn even before the broader market peaks.”

Bitcoin has seen explosive growth over the past year. Trading at just over $1,000 at the beginning of 2017, the flagship cryptocurrency peaked at an all-time high of $20,000 in December. While it has since fallen to roughly $15,000 per coin, this figure still puts it at a 1500% increase from 2017 to 2018.

This growth has financial analysts and experts from Mike Novogratz to CNBC Mad Money Host Jim Cramer and beyond crying that Bitcoin has achieved official bubble status. As did those before him, Grantham has drawn comparisons to the Dutch Tulip Mania of the 17th century and “the legendary South Sea bubble”, as he calls it, of 1719-1720.

Part of a Larger Trend

To Grantham, Bitcoin’s speculative rise coincides with the stock market’s own bubbling over.

“I recognize on one hand that this is one of the highest-priced markets in US history”, Grantham conveys in the report. “On the other hand, as a historian of the great equity bubbles, I also recognize that we are currently showing signs of entering the blow-off or melt-up phase of this very long bull market.”

Throughout his report, he continues to list examples of historical market downturns, complementing his analysis with charts that illustrate these trends. The writing is on the wall for the next market meltdown, he believes, and this includes “the crazy Bitcoins of the world.”

“We know we’re not there yet, but we can perhaps see come early movement: increasing vindictiveness to the bears for costing investors money…the increasingly optimistic tone of press and TV coverage”

Grantham finds this last point especially indicative. Once market talk takes up the majority of airtime, “just as late 1999 featured Pets.com–we are probably down to the last few months.”

“Good luck. We’ll all need some”, he concludes.

Not Everyone is Convinced

Throughout 2017, we saw the induction of Bitcoin futures and filings for Bitcoin ETFs, as the formerly fringe cryptocurrency market stepped into institutional spotlights. All the while, cries of a bubble resounded from financial powerhouses as the market continued to transcend new all time highs.

Even while the echos of bubble talk seem uniform, not everyone in the financial world is in agreement over Bitcoin and its speculation. Jeffrey Kleintop, chief strategist at investing firm Charles Schwab, recently dismissed comparisons of Bitcoin to the dot.com and housing bubbles. Unlike Grantham, he believes Bitcoin is maturing independently from the rest of the market, and he’s also more optimistic than Grantham going into 2018.

And he’s not alone. This week, news broke that Peter Thiel’s venture capital firm, the Founders Fund, holds hundreds of millions of dollars in Bitcoins, up from an initial investment of $15-20mln. Thiel believes that Bitcoin has “great potential”, especially if the cryptocurrency continues its track to becoming “the cyber equivalent to gold.”