The SEC announced Wednesday that the ETF proposal, filed by Bitwise Asset Management in conjunction with NYSE Arca, did not meet legal requirements to prevent market manipulation or other illicit activities. The SEC placed the burden on NYSE Arca, rather than Bitwise’s proposal itself.

The U.S. Securities and Exchange Commission (SEC) has rejected the latest attempt at creating a bitcoin exchange-traded fund (ETF).

To date, the SEC has rejected all bitcoin ETF proposals, citing market manipulation and fraudulent activity concerns.

The order read:

“The Commission is disapproving this proposed rule change because, as discussed below, NYSE Arca has not met its burden under the Exchange Act and the Commission’s Rules of Practice to demonstrate that its proposal is consistent with the requirements of Exchange Act Section 6(b)(5), and, in particular, the requirement that the rules of a national securities exchange be ‘designed to prevent fraudulent and manipulative acts and practices.’”

Bitwise first filed the ETF proposal with NYSE Arca in January 2019, kicking off its most recent push to offer retail customers a regulated bitcoin product. The company sought to be the first firm to launch an ETF in the U.S., alongside competitor VanEck, which filed a similar proposal in January with SolidX and Cboe BZX.

VanEck pulled its version last month.

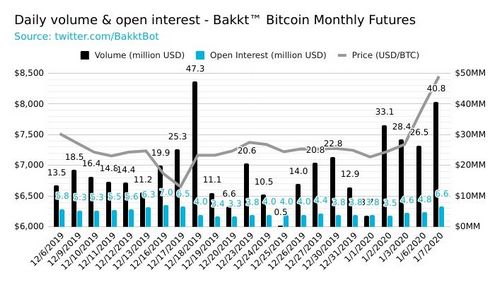

Bitwise tried to reassure the regulator that issues relating to market manipulation and fraudulent activity could be addressed, publishing a number of reports on what it saw as the “real” bitcoin market and showing that market activity correlated tightly with the regulated bitcoin futures markets.

With Wednesday’s rejection, the SEC only has one bitcoin ETF proposal currently sitting before it, filed by Wilshire Phoenix and NYSE Arca.

Non-Seizability of Bitcoin Very Attractive for Hong Kong: Pompliano

Bitcoin’s (BTC) use as a protector of wealth is coming to the fore in Hong Kong as trading volumes spike and businesses iron out problems with acceptance.

Trading record underscores Bitcoin’s “non-seizability”

As multiple commentators including Morgan Creek Digital co-founder Anthony Pompliano noted this week, Bitcoin is a genuine solution for Hong Kong residents worried about monetary sovereignty.

“When you’re worried about your assets being seized or becoming inaccessible to you, Bitcoin’s non-seizability becomes very attractive. This aspect of Bitcoin just became important for 1+ billion people in India Hong Kong”, he tweeted on Oct. 6.

Pompliano was writing days after China’s 70th state anniversary protests, as big as any in the democracy movement’s 18-week history, were met with a forceful reaction from the government.

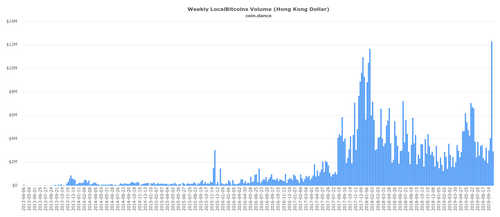

In the face of a crackdown on civil liberties via emergency powers, monetary freedom also took a hit, with worried residents forming queues at ATMs. Hong Kong saw a giant spike in trading on P2P Bitcoin exchange Localbitcoins, seeing 12.3 million HKD ($1.57 million) change hands in the week ending Sept. 28.

Hong Kong Free Press Escapes ‘Clutches of BitPay’ – Switches to BTCPay

Local entities eyeing possibilities for escaping the grip of authorities had already considered Bitcoin, but it was the teething problems that hit the headlines.

As Cointelegraph reported, the Hong Kong Free Press (HKFP) had complained about payment processor BitPay failing to pass on donations to its cause.

BitPay blamed the banking system, sparking a debate about the irony of relying on fiat via third parties in order to use Bitcoin.

As of Oct. 10, however, the HKFP had resolved the issue, founder Tom Grundy revealed – by switching to open-source alternative BTCPay.

“HKFP has escaped the clutches of BitPay and… now accepts Bitcoin again via BTCPay”, he confirmed.