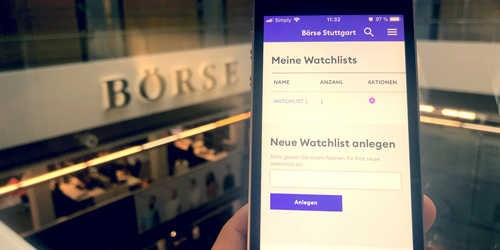

Trading began today on Boerse Stuttgart Digital Exchange (BSDEX), a fully regulated digital asset exchange under the German Banking Act, according to a statement. As of now, BSDEX is trading only one pair, the bitcoin-euro.

Exchange Boerse Stuttgart, Germany’s second-largest stock exchange, has opened a regulated trading venue for digital assets, the company said.

The exchange announced plans to launch a fully regulated digital asset exchange in December 2018, initially planned for launch in the first half of 2019.

BSDEX will open for German retail and institutional investors slowly followed by the entire EU, the exchange noted. Like other cryptocurrency exchanges, trading will be open nearly 24/7. Speaking with CoinDesk, the exchange said it plans on adding ethereum, litecoin, and XRP euro trading pairs this year and tokenized assets sometime in 2020.

“The market in cryptocurrencies is worth billions, and more digital assets will emerge on the basis of blockchain”, CEO Dr Dirk Sturz said in the statement. “Our goal is to build up the leading European trading venue for those assets.”

Boerse Stuttgart partnered with SolarisBank on the initiative. The bank will process payments and custody euro funds.

“BSDEX will give retail and institutional investors direct access to digital assets and provide flexible and relatively low-cost trading. We believe blockchain is set to bring about significant changes in the financial industry, and we want to leverage its potential to create the trading venue of the future”, said Peter Großkopf, CTO at BSDEX, in a statement.

A year ago, Boerse Stuttgart announced the launch of an initial coin offering (ICO) platform and more recently started trading litecoin and XRP exchange-traded notes (ETNs).

China’s Central Bank: Digital Currency Has ‘No Timetable’ for Launch

China has no specific launch date in mind for its digital currency, its central bank has said in fresh comments contradicting previous statements.

Central bank governor: We need time to research

As local English-language news outlet Global Times reported on Sept. 24, the People’s Bank of China (PBoC) has now denied Beijing is ready to debut its new financial asset.

According to the publication, which did not quote governor Yi Gang directly, the PBoC “needs to research, test, evaluate and prevent risks.”

“China’s research and development of digital currency has achieved positive progress, but the country has no timetable to launch a digital currency so far”, it summarized.

Conflicting official accounts

The remarks contrast with those made by deputy director Mu Changchun in August. As Cointelegraph reported, at the time, the impression from the PBoC was that the digital currency was complete and awaiting launch.

This, he added, could happen before the end of 2020, when Facebook plans to release its own private digital currency, Libra.

The PBoC had indicated the development of its own token had accelerated as a direct response to Libra, despite authorities eyeing a digital currency for several years.

Earlier this month, Mu suggested it would help secure monetary sovereignty and formed part of prudent economic policy planning.

Yi meanwhile also played down significance in that area, saying the digital currency would replace part of the yuan’s M0 money supply, rather than touch M1 or M2.