As Cointelegraph reported recently, Binance.US will launch 13 fiat-to-crypto and crypto-to-crypto trading pairs initially.

Binance.US, the United States branch of major crypto exchange Binance, announced that its users will be able to deposit five cryptocurrencies, namely: Cardano (ADA), Basic Attention Token (BAT), Ethereum Classic (ETC), Stellar (XLM) and 0x (ZRX).

According to the announcement published on Sept. 23, these coins are currently only available for deposits. Withdrawals will not be enabled until trading goes live.

The post also includes several new trading pairs:

“USD Pairs: ADA/USD, BAT/USD, ETC/USD, XLM/USD and ZRX/USD.

USDT Pairs: ADA/USDT, BAT/USDT, ETC/USDT, XLM/USDT and ZRX/USDT.”

An expanding list

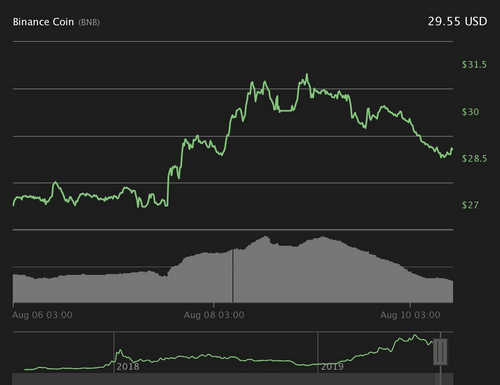

The trading pairs include major cryptocurrencies such as Bitcoin, Ether (ETH), Ripple’s XRP, Bitcoin Cash (BCH), Litecoin (LTC), Binance Coin (BNB) and Tether (USDT).

Binance.US services will initially be available in the U.S. with the exception of 13 states.

As part of an international expansion plan, at the beginning of the year, Binance opened a crypto-fiat platform on the island of Jersey, where users can trade British pounds and euros for Bitcoin and Ether.

Crypto Custodian Secures $8M in Funding Round Led by Initialized Capital

Montreal-based digital asset custodian Knøx has secured $8.25 million in a seed round to support its crypto custody service for institutional customers and fiduciaries.

The funding round was led by San Francisco-based venture capital firm Initialized Capital, with the participation of financial services giant Fidelity and venture firm iNovia, Canadian technology-focused news outlet BetaKit reported on Sept. 24. Knøx intends to allocate the raised money to further develop its offerings.

Protection of customers against losses

Knøx’s products are geared to asset management firms, liquidity providers and exchanges, specifically addressing the issue of customers’ protection against losses. Commenting on the matter, Garry Tan, a managing partner at Initialized Capital, stated that “there is a growing appetite for more comprehensive insurance policies covering digital asset custody”, while Alex Daskalov, co-founder and CEO of Knøx, said:

“Entities who have their digital assets managed by a third party deserve the right to insurance. Too often, insurance policies are purchased for marketing purposes instead of transferring the risks that matter. Our insurance program is designed to help fiduciaries meet their obligations.”

Backing of other blockchain startups

In July, Initialized Capital led a $3.75 million seed round for blockchain-powered video game studio Horizon Blockchain Games. iNovia – alongside other major blockchain investors such as Polychain Capital and Digital Currency Group – also participated in the funding round.

This spring, Initialized Capital alongside Pantera Capital, Foundation Capital and Y Combinator, backed the United States-based startup Sparkswap, which aimed to create a decentralized exchange based on the Bitcoin Lightning Network.