Ethereum (ETH) is currently trading at around $159, up more than 6 percent on the day at press time. The second-largest cryptocurrency is seeing around 35 percent gains over the week, and 47 percent gains over the month.

Bitcoin has shown slight growth today, up by around 3 percent and trading at about $3,899 at press time. Over the month, Bitcoin is up almost 1 percent and almost 7 percent over the week.

Saturday, Jan. 5 – the crypto markets are mainly in the green today, as Bitcoin moves closer to the $3,900 mark, data from Coin360 shows.

Bitcoin 7-day price chart.

This week, developers from Ethereum discussed the possibility of implementing a new proof-of-work (PoW) algorithm that would raise the efficiency of GPU-based – rather than ASIC-based – mining on the network. The debate over whether to go forward with the implementation comes ahead of the upcoming Ethereum Constantinople hard fork.

Ethereum’s 7-day price chart.

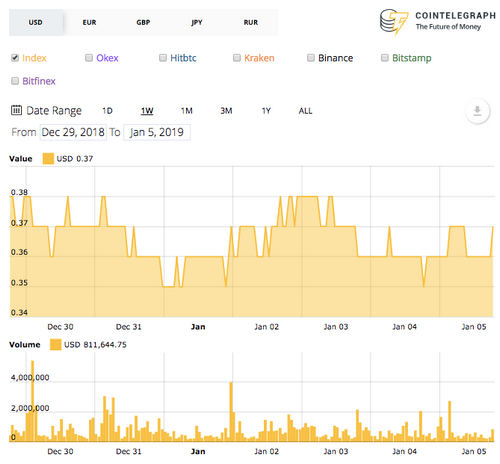

Third-largest cryptocurrency Ripple (XRP) is up over 2 percent at press time, trading at around $0.36. Over the week, the coin has seen more than 7 percent growth, and almost 5 percent gains over the month.

Ripple 7-day price chart.

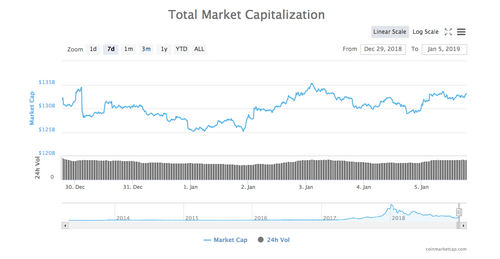

The total market cap of all cryptocurrencies is currently around $133 billion at press time, up from its weekly low of about $125 billion.

7-day chart of total market capitalization of all cryptocurrencies from CoinMarketCap

Of the top ten cryptocurrencies, Litecoin (LTC) and TRON are showing the biggest growth, up over 12 and 15 percent respectively.

Earlier this week, the Gemini crypto exchange – founded by the Winklevoss twins in 2014 – released a series of ads calling for better regulation of the crypto space. The ads, which read “Crypto needs rules”, were received with mixed reactions from the crypto community, as some believe the space suffers from the intervention of regulators.

Also this week, five more crypto exchanges – including Coincheck – joined Japan’s self-regulatory association of cryptocurrency exchanges.