Now, investors are celebrating advances that could make Litecoin transactions become more private. Litecoin values have been remarkably stable this week, even as volatility churns the broader cryptocurrency market.

LTC/USD Price Levels

The LTC/USD exchange rate traded within a narrow range on Wednesday. It reached a session high of $63.73, with daily lows limited to $62.56. At press time, LTC/USD was valued at $63.38 for a gain of 1.1%.

Prices have been capped below $70 for the better part of two months. Litecoin lost about a third of its value after China decided to ban cryptocurrency exchanges. The digital currency had traded at record highs prior to the decision.

Litecoin is the fifth most capitalized cryptocurrency at $3.46 billion. It has a total supply of 53.84 million units, according to CoinMarketCap.

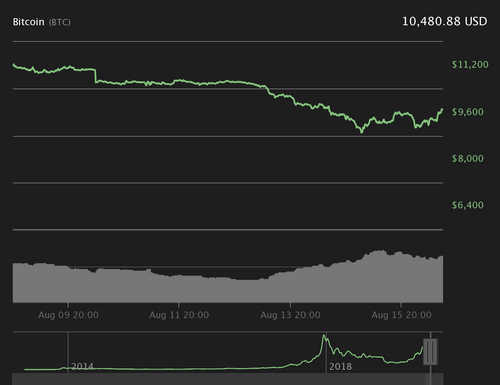

In the broader cryptocurrency market, a tug of war between bitcoin and Bitcoin Cash has led to volatile price moves, with each currency taking turns adding and losing value. On Thursday, bitcoin (BTC/USD) gained the upper hand by climbing back toward $7,300.

Korea Factor

Many analysts say Litecoin is poised for a large breakout thanks to rising demand in South Korea. The Asian country is the world’s leading hub for all things Litecoin. World’s biggest cryptocurrency exchange Bithumb accounts for more than a quarter of LTC trade flows globally. Recently, local exchange Coinone added Litecoin to its list of available currencies. Just 24 hours later, the platform processed more than $3.2 billion worth of transactions.

South Koreans are active not just in Litecoin, but many of the other less popular coins. They were at the center of the Bitcoin Cash market long before it caught fire, and have shown a greater propensity to back other volatile cryptocurrencies.

Activity in South Korea, which is largely driven by LTC/won pairs, is expected to be a major storyline in Litecoin’s future.

Charlie Lee Weighs In

Liecoin architect Charlie Lee recently told media he “looked forward to adding” new improvements to the blockchain, especially as it pertains to confidential transactions (CT). Lee recently told Greg Maxwell of Xiph.org that he is working on addressing the lack of fungibility facing cryptocurrencies such as Litecoin and Bitcoin. This is at the heart of a broader debate over CT, which would allow transactions to be visible only to the sender, receiver and whichever party they choose to view the information.

In Lee’s view, this upgrade can be accomplished via soft fork of the Litecoin blockchian. He first published this view in a Nov. 14 tweet:

“I’m excited to see progress on Confidential Transactions. Fungibility is the only feature of good money that Bitcoin/Litecoin is missing.

I look forward to adding this to Litecoin when it is ready. And this can be done with a soft fork. Stay tuned!”

Confidential Transactions were first introduced in 2013 by Adam Back. Since then, the phrase has referred to a particular approach to transaction privacy based on additive homomorphic commitments.