The seven-day moving average of the number of addresses holding 10,000 bitcoins or more rose to 111 on Wednesday, the highest level since Aug. 2, 2019, according to blockchain intelligence firm Glassnode. That number has risen by more than 11% since early March.

Large crypto investors, popularly known as “whales”, seem to be accumulating bitcoin amid the ongoing price rally.

“The increase in the number of BTC addresses with more than 10,000 BTC is likely the result of long-term holders coming back online to expand their holdings”, said Matthew Dibb, co-founder of Stack, a provider of cryptocurrency trackers and index funds.

Increased interest from long-term holders and large investors could be associated with the bullish narrative surrounding the macro factors and the upcoming reward halving.

“Some of these addresses may belong to high-net-worth individuals or groups, who are diversifying into bitcoin amid the ongoing coronavirus pandemic and ahead of the mining reward halving, due in the next two weeks”, said Wayne Chen, CEO of Interlapse Technologies and founder of Coincurve, a cryptocurrency purchasing, and spending platform.

Bitcoin’s supply is capped at 21 million and its monetary policy is pre-programmed to cut the pace of supply expansion by 50 percent every four years.

Hence, many advocates tout bitcoin as a safe haven asset and an inflation-hedge like gold. They claim the economic destruction caused by the coronavirus pandemic and the unprecedented money printing exercises undertaken by the global central banks and governments to bode well for bitcoin’s price.

“Amid the deteriorating economic outlook for the U.S. economy and the likelihood of an ever-increasing monetary supply, which weakens the U.S. dollar and stokes inflation fears, we believe bitcoin could easily test previous highs above $19,000 as investors look for safe havens away from traditional assets,» said, Simon Peters, analyst and crypto asset expert at global investment platform eToro.

Such bullish predictions have been doing the rounds for more than six weeks now and could have enticed large investors to add bitcoins to their portfolio.

Further, expectations that the mining reward halving, due on May 12, would put bitcoin on a long-term bullish trend could be the reason for the rise in the number of so-called “whale addresses.”

Bitcoin undergoes a process called mining reward halving every four years, which controls inflation by reducing mining rewards by 50%. Following the May 2020 halving, the reward per block mined will drop from 12.5 BTC to 6.25 BTC.

Many investors anticipate the cryptocurrency’s price would go up after halving, as the asset would become more scarce to satisfy the demand. Reinforcing this belief is the historical data, which shows bitcoin experienced solid bull runs in the year following previous halvings.

“At the first halving in November 2012, the price went from $11 to over $1100 a coin a year later. Then after the second halving in July 2016, bitcoin went from $600 to over $20,000 by the end of 2017,» said George McDonaugh, managing director and co-founder of publicly listed cryptocurrency and blockchain investment firm KR1 plc.

However, reward halving also means a 50% reduction in miners’ revenue. So, if the price fails to rally sharply post-halving, small and inefficient miners may shut down operations and offload their holdings to cover costs, leading to a price drop.

Bullish narrative reinforced

Bitcoin was trading near $8,900 at press time, a 130% gain from the low of $3,867 reached on March 13, according to CoinDesk’s Bitcoin Price Index.

Bitcoin is now reporting a bigger year-to-date gain compared to gold. While the cryptocurrency is up 21%, the yellow metal has seen a 12% increase.

The year-to-date performance may reinforce the narrative that bitcoin is a hedge against global economic malaise, fiscal and monetary indiscipline and could continue to draw demand from both small and large investors.

«The year-to-date performance indicates that investors’ awareness of the digital asset has increased and its role as a potential diversification vehicle for traditional portfolios has been underscored by its strong recovery from its recent lows, relative to more traditional markets. We expect this strength to persist as Bitcoin continues to take pole position in the race,» said Stack’s Dibb.

Not a perfect indicator

The rise in the number of unique addresses holding more than 10,000 bitcoins does not necessarily mean an influx of new whales into the market. After all, a single investor can hold multiple addresses.

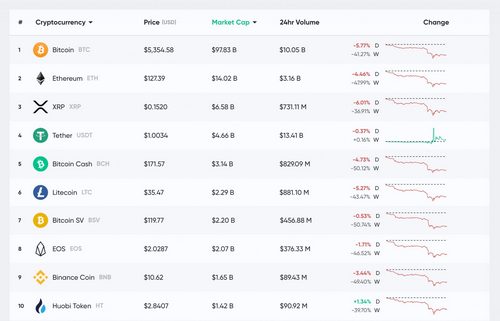

Further, cryptocurrency exchanges tend to hold large balances. For instance, two of the top five addresses on the rich list (a table of the addresses holding the most bitcoins), published by bitinfocharts.com, belong to prominent exchanges Huobi and Bitfinex.

“Some of these addresses are owned by top exchanges which usually hold large reserves in their cold wallet. So this doesn’t necessarily signal a clear behavior for market activity”, said Coincurve’s Chen.