Bitcoin volatility has been noticeably high over the past week. This happened against the background of how the cryptocurrency was making attempts to overcome the milestone above 24 thousand dollars.

According to experts, large short-term fluctuations in the value of BTC are due to a combination of four factors: cascading liquidations, high funding rates, a slowdown in the flow of funds to the Grayscale investment fund and the expected correction of the asset after a steady growth.

We checked the current market situation: today the capitalization of the cryptocurrency niche exceeds $ 658 billion. At the same time, exactly a month ago, the figure was at the level of 585 billion.

Bitcoin dominance among other cryptocurrencies is 66.8 percent, and its rate is $ 23,713. Over the past month, the coin rate has indeed experienced many collapses and sharp increases. That is why representatives of the blockchain community wondered about the reasons for this.

Why is the Bitcoin rate jumping?

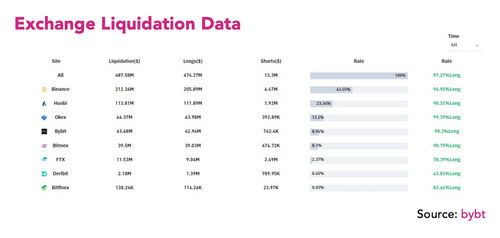

BTC price plummeted on December 20 after hitting $ 24,295 on Binance. At this level, many really expected a pullback. However, over the next 17 hours, the chart dropped to $ 21,815. The sharp collapse is to blame for the cascade of liquidations of long positions of margin traders on the largest futures exchanges, including Binance, OKEx and Huobi.

In the futures market, buyers and sellers borrow more money to trade larger amounts, LongHash reports. For example, the standard leverage in the futures market is up to 100x. This means that a trader can place a $ 100K position for just $ 1,000.

If the leverage is higher, the liquidation price is closer to where the trader buys or sells bitcoins on the chart. Consequently, if the market uses excessively high leverage, the risk of a large number of liquidations in a short period of time increases.

On December 21, when the price of BTC fell below $ 22,000, long positions worth hundreds of millions of dollars were closed. Data from the Bybt.com platform showed that $ 474 million in futures contracts were liquidated within four hours. A cascade of liquidations creates a lot of volatility because it forces traders to either buy or sell their positions for a limited period of time. In the case of Bitcoin on December 21st, many long holders suffered a massive liquidation, leading to a decline in the price of the asset.

The easiest way to assess whether the futures market is leaning in favor of buyers or sellers is with the funding rate. Futures exchanges use a system called financing to guarantee the balance in the market. Funding requires buyers to compensate sellers if there are more firsts in the market, and vice versa. Therefore, if the level of funding is high, it means that the futures market is overflowing with buyers. From December 20 to December 21, the funding rate in the BTC trading pair was especially high, reaching at some point a value of 0.1 percent.

In addition, the suspension of deposits in the GBTC and ETH funds of the Grayscale company had a great impact on the volatility. This is the main source of buying demand for bitcoins for large investors and has begun to decline, increasing the chances of a deep correction. However, the demand from institutions for Bitcoin remains at a high level, so so far we have received only an increase in volatility, not a dump.

Note that now the Bitcoin rate looks good, because there is very little left to the historical maximum. In addition, the situation with BTC was improved by the lawsuit of the Securities and Exchange Commission against Ripple, since against the background of the XRP rate sinking, many investors transferred their funds to the first cryptocurrency, thereby increasing its rate and the level of dominance in the niche.

We believe that Bitcoin surprised most of its investors in 2020. Despite the abundance of problems in 2020 for the world economy and humanity as a whole, the cryptocurrency not only managed to recover from its serious fall in March, but also set a new historical maximum. And this creates conditions for the further growth of other cryptocurrencies, the records of which began to seem much closer.