Bank of America has released the results of a recent survey of professional investors regarding their views on Bitcoin. As it turned out, almost 75 percent of respondents believe that the main cryptocurrency is in a «bubble», that is, its growth is allegedly driven solely by the desire of investors to make money.

The survey involved 200 people who manage assets totaling $ 533 billion. Only 16 percent of them are confident that BTC cannot be assigned a bubble status, while 10 percent refrained from answering. Let’s talk about the situation in more detail.

By tradition, let’s start with an explanation. Bitcoin is often referred to as a «bubble» and has even been compared to tulip mania, a process of mass speculation on flowers in the Netherlands. However, such comparisons are irrelevant, since the cryptocurrency industry has been around for a long time. In particular, the BTC network has been operating since January 2009, that is, for more than twelve years. Accordingly, the asset not only held out during all this time, but also regularly shows new rate records.

As previously noted by the co-founder of 10T Holdings fund Dan Tapiero, for the well-deserved title of the «bubble», Bitcoin must cost at least 320 thousand dollars. However, this is not enough: the growth had to happen in a much shorter time frame.

And although the reputation of cryptocurrencies continues to improve, and global giants like Tesla and MicroStrategy are investing in it, some investors still do not trust the asset and criticize it. Here is their point of view.

Should you buy Bitcoin right now?

More than 30 percent of survey participants said technology stocks were too overpopulated. That is, most traders believe in their growth, which does not always end with growth. What’s more, 27 percent of respondents describe Bitcoin as an «overpopulated» deal and only 10 percent are confident that BTC will outperform the aforementioned stocks in 2021, Cointelegraph reports.

The latest Bank of America study shows significant skepticism about Bitcoin after the bank’s analysts the day before called the cryptocurrency «extremely volatile, impractical and environmentally hazardous.»

However, there is also a directly opposite opinion, which the experts of the Vailshire Capital fund adhere to. According to CEO Jeff Ross, the main cryptocurrency is still a «great buy» as it recently hit an all-time high. Now Bitcoin has overcome the last resistance from sellers and is ready to conquer new heights. Here’s a quote from Ross on Twitter about the matter.

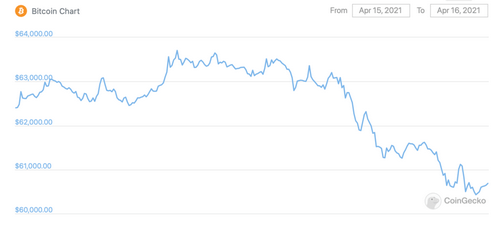

A healthy retest of the previous line in a rising wedge on the Bitcoin chart. Market sentiment: insanely bullish. On the state of the Bitcoin network: wild optimism. View: The price should close above the old ceiling of $ 61,250 and then rise sharply. A great opportunity to buy before the next cryptocurrency takeoff.

That is, the expert considers cryptocurrency to be a good asset to acquire, even though its current rate is not far from its historical maximum. Recall that the BTC rate record is $ 64,804 – it was recorded on April 14.

Naturally, in this case we are not talking about an investment for a week or a month. The analyst clearly suggests investing for a longer period, which usually allows one to feel the full potential for growth. However, this requires endurance and the ability to hold.

Note that today Bitcoin has already managed to fall below the level marked by Jeff Ross. During the day, the BTC rate fell by 2.8 percent, due to which the local bottom of the asset value was $ 60,426. However, since the expert considered the cryptocurrency a «great buy» at $ 62,000 per coin, the lower rate should be even more attractive.

We believe that the increased attention of professional investors to cryptocurrency only adds points to its reputation. Yet now blockchain assets have ceased to be an instrument of speculation, as was previously thought, and have completely turned into a means of preserving and increasing capital.

But since the growth rates of the same BTC significantly exceed classic assets such as stocks or gold, experts cannot get used to it. Therefore, it is easier for them to dub Bitcoin a bubble than to understand the advantages of cryptocurrency and the possibilities of decentralization. This means that coin holders have nothing to worry about: this only once again reminds of the incredible speed of development of the blockchain industry.