The rise in the Bitcoin exchange rate in recent months has brought huge profits to traders and miners of the main cryptocurrency.

In addition, bull run has a very positive effect on the stock prices of companies closely associated with BTC mining.

At the same time, their value is growing so quickly that it can even compete with the volatility of the digital assets themselves. Decrypt has compiled a selection of the hottest mining stocks in recent memory. We will tell you how this trend is explained.

Bitcoin and the stock market

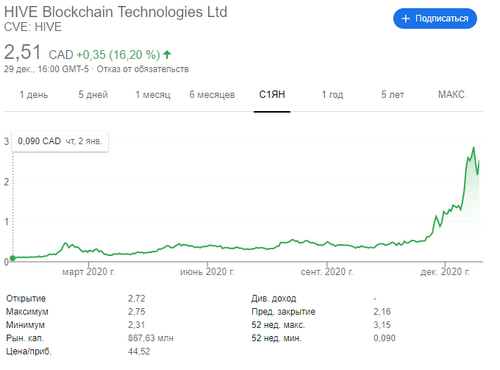

The first place in the ranking went to HIVE Blockchain Technologies, whose shares have risen in price by 27 percent over the past day.

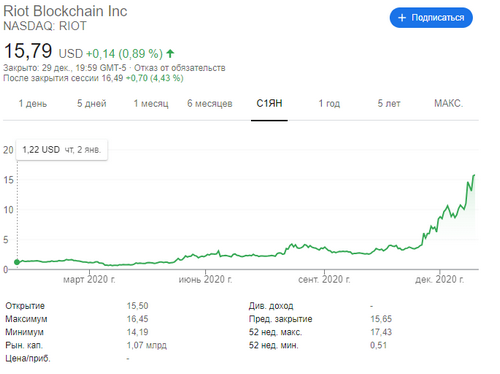

Another company, Riot Blockchain, was marked by a rise in the value of securities by at least 22 percent.

Marathon Patent Group – one of the largest mining companies in the United States – came in third on the list, with shares rising 12 percent.

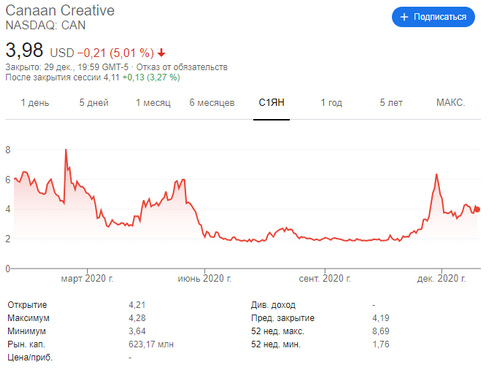

Both Riot and Marathon announced last week that they are upgrading their mining hardware. ASIC miner manufacturer Canaan Creative is also up nearly 10 percent at the time of writing. At the same time, the share price of this company has dropped significantly in comparison with the beginning of the year.

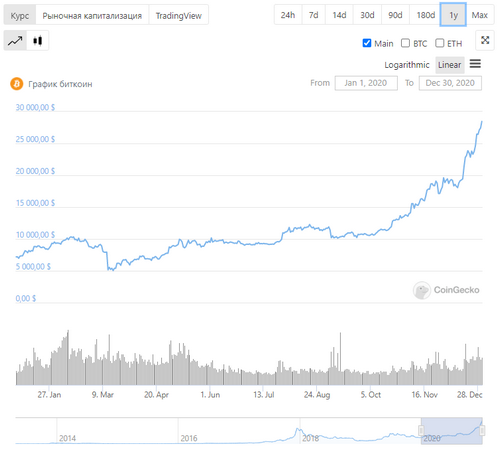

The main reason for the jump in this sector of the stock market is the very rapid rise in the value of Bitcoin in recent times. In December, the main cryptocurrency constantly updated its historical maximum, reaching the $ 28 thousand mark. BTC also set another record at $ 28,561 today.

Note that analysts expect this trend to continue. For example, the famous billionaire Ray Dalio is confident in the reality of BTC growth above the $ 100 thousand mark. At the same time, some analysts are expanding this framework to 288 thousand dollars per bitcoin, and by the end of next year. Read more about the expectations of experts in a separate article.

With the growth of mining profitability, this process becomes even more interesting in the eyes of investors. In addition, mining is the main component in ensuring the security of the Bitcoin network from various types of attacks. Torkel Rogstad, developer of research firm Arcane, is confident that the value of mining companies will continue to grow in the near future. Here is a quote from him.

If I had to associate all this with some kind of trend, I would call the limited access of institutions to Bitcoin. Personally, I can invest in whatever I want, but if you invest your retirement portfolio, you can only invest in stocks. It’s the same with funds, they usually have very strict rules on what they can invest in – the so-called investment mandate.

In other words, despite all the big investments in BTC from big companies this year, many organizations are still unable to convert their capital to cryptocurrency. However, wanting to capitalize on its growth, they will begin to invest as much as possible in cryptocurrency-related instruments on the traditional market – including in the shares of mining companies. It turns out that those who are not able to do it directly are actively investing in companies related to cryptocurrencies.

We believe that the current trend is quite interesting. It proves that the size of the current run of the cryptocurrency industry is much larger and is not limited solely to the growth of coins. On what is happening today, ordinary investors can also make money, who are still afraid to contact coins directly and prefer to invest in stocks.

Judging by the numbers, even this tactic works. This means that the opportunities for earnings associated with cryptocurrencies are even wider than it seems at first glance.