Xiaomi and Huawei, both of which have long thrived in China, are growing steadily in Europe despite shrinking sales of handsets and competition from better-known brands. Their strong sales there come as the US market grows increasingly unfriendly to Chinese smartphone firms, with regulators taking measures to restrict the operations of certain Chinese tech companies in the country.

Two of the world’s major smartphone companies are still waiting to break into the US. But in the mean time, they’re getting an increasingly warm welcome from consumers across the Atlantic.

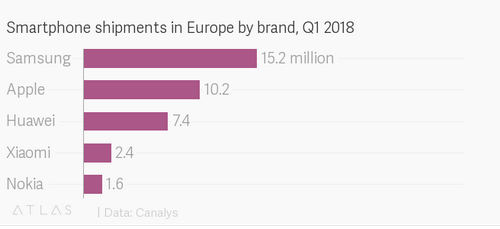

Data from research firm Canalys shows that during the first quarter of 2018, smartphone shipments across Europe fell 6.3% compared to the year prior.

While they remained Europe’s top selling phone brands, shipments from Samsung and Apple fell 15.4% and 5.4% respectively. But Huawei, which has sold phones on the continent for years and is also a major provider of telecom infrastructure there, grew nearly 40%. Meanwhile, Xiaomi, which only began selling its phones in Europe in late 2016, already ranks as the continent’s fourth largest vendor. According to Mo Jia, an analyst at at Canalys, this quarter marks the first time Xiaomi has ranked as a top-five vendor across the continent.

After launching in Russia and Spain in 2017, Xiaomi is now planning a much wider rollout across Europe, including the UK and Ireland, as it gears up for an IPO.

Huawei and Xiaomi’s success in Europe is a contrast to their standing in the US.

In Huawei’s case, it has been largely shut out since the US House Intelligence Committee in 2012 issued a report warning telco providers against purchasing networking equipment from Huawei, citing a potential threat to national security due to alleged ties to the Chinese government. Huawei disputed the report (paywall) after its release.

In Xiaomi’s case, while its smart TVs and some accessories are available in the US, its phones have yet to go on sale there. Earlier, Xiaomi’s weak patent portfolio likely kept it out of the US. But it has since formed patent-sharing agreements with Microsoft, Qualcomm, and Nokia that can help it sell devices in new markets without fear of litigation. The company has stated it intends to bring its handsets stateside by late 2018 or early 2019.

That could be an optimistic projection, with telecom firms feeling the heat as US has grown more wary of Beijing’s influence over the global technology industry. Last year, for example, there were signs Huawei would finally get a carrier agreement, but in January news broke that AT&T and Verizon had backed off from plans to sell Huawei’s phones due to pressure from the US government. It has since laid off key US employees (paywall).

Apart from Huawei, the US government has taken aim at ZTE, another Chinese smartphone company, which had quietly become the fourth-largest handset seller in the US in recent years despite also being a focus of the 2012 intelligence committee report. The Department of Commerce in April ordered US suppliers to cease selling components to ZTE, for failing to comply with the terms of a plea deal over violations of sanctions on Iran and North Korea. The ban has caused ZTE to cease operations.

Still, with Xiaomi seeing such promising sales on the continent, the US can probably wait.